Manulife Investment Management (Manulife IM) has acquired a majority stake in data center operator Serverfarm.

The investment firm, on behalf of Manulife Infrastructure Fund II and its affiliates, this week announced that it has entered into a definitive agreement to acquire a controlling interest in Serverfarm.

Terms of the investment weren’t shared, but the investment was described by Manulife as “significant” and set to close in Q3 2023.

Manulife said it and Serverfarm’s existing investors would provide capital to the data center firm to continue its expansion and “capitalize on attractive market opportunities” across North America, Europe, and Israel.

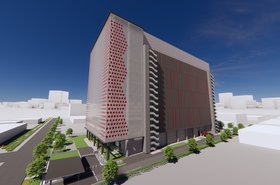

Founded in 2009 by real estate development firm Red Sea Group (RSG), Serverfarm currently operates a portfolio of nine data centers across North America (Moses Lake, Washington; Los Angeles, California; Atlanta, Georgia; two in Chicago, Illinois; and a Canadian facility in Toronto, Ontario), Europe (London and Amsterdam) and Israel totaling more than 1.5 million gross square feet (139,355 sqm) and 125MW of IT capacity. The company has reportedly secured additional land for future data center developments.

Manulife Investment Management is the global brand for the wealth and asset management segment of Manulife Financial Corporation. Its investments include APAC real estate investment firm Arch Capital - which recently launched a new data center platform - and a $150 million investment in Sabey Data Centers.

Last year Manulife sold an office and Rogers-occupied data center complex in Ottawa, Ontario to Canadian real estate firm Regional Group. 2022 also saw Blackstone Infrastructure Partners acquire a 35 percent stake in Phoenix Tower International from Manulife.

Citigroup Global Markets Inc. is serving as the lead financial advisor, TD Securities is serving as financial advisor, and Dentons US LLP and Alston & Bird LLP are serving as legal counsel to Serverfarm.

TAP Advisors LLC is serving as financial advisor, and Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal counsel to Manulife Investment Management.