French cloud and data center services provider OVHcloud plans to raise €400 million ($469m) in an initial public offering in Paris.

The Wall Street Journal reports that the listing could value the business at more than $4.7bn. Launched in 1999 as OVH, the company has pitched itself as a European alternative to US and Chinese hyperscale giants like Amazon, Google, Microsoft, and Alibaba.

In 2017, OVH picked up VMware’s failing public cloud effort vCloud Air, and consolidated the underlying hardware into its own data centers, as well as giving it a footprint in the US.

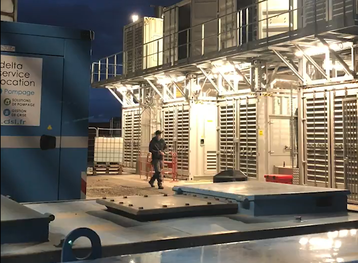

The company first started the IPO process in early March, just days before a disastrous fire which destroyed its SBG2 data center in Strasbourg, and disabled another facility on the same site.

OVHcloud has attempted to restore customer servers and data where possible, but some data was irrevocably lost. The company has promised to set up a fire safety laboratory. The final report on the cause of that fire will not be published until 2022, after the IPO has taken place - a delay which OVHcloud says is due to the involvement of authorities including the French government, and insurers. Ahead of the fire, a separate inspection of OVHcloud's Roubaix data center found that it lacked sufficient fireproofing in its battery rooms.

The disaster did not scupper OVHcloud's IPO plans. "We could keep on growing like we have been, but the whole momentum around data sovereignty is a deep wave," an OVHcloud spokesperson told DCD in June. "The market for cloud in Europe is expected to overtake telco by 2030."

In its IPO listing, the company said that it was targeting revenue growth of 10-15 percent for 2022 and organic revenue growth rate in the mid-twenties by 2025.

No dividend payments are expected any time soon, with cash-flows set to be reinvested.

Octave Klaba, company founder and chairman, and his family will maintain a majority stake in the business, even after the listing.