When companies claim to be using 100 percent renewable energy, they may not be 100 percent truthful. It's up to us to keep them honest.

Using renewable energy is an important way data centers can reduce their environmental footprint, and operators are competing to promise a shift to 100 percent renewable energy sources. Microsoft announced back in 2012 that it was 100 percent carbon neutral. Other claims have come from Google and Amazon.

But there have been problems with some of those claims.

Ditch the RECs

Ideally, data centers would buy renewable power from their local grid utility, but most utilities can't provide all the renewable energy they need, at the time when they need it.

So data centers have resorted to various ways to invest in green energy that will offset their own use of dirty energy. A lot of those efforts have revolved around renewable energy certificates (RECs) and energy attribution certificates (EACs)- and many of these certificates are no better than greenwash.

When a provider generates a megawatt-hour (1MWh) of renewable power, it is issued with a REC. If someone uses that power, they can retire that REC and add that 1MWh to their green energy total. These RECs can be sold separately to the power ("unbundled RECs), so a customer can buy a REC associated with energy used on a different electricity grid, and take credit for that renewable energy.

These RECs are considered to be a low-quality form of renewable energy investment because there is no guarantee that the renewable energy was actually consumed or that any new renewable energy capacity was built to match the demand.

Buying an unbundled REC is similar to buying a carbon offset for the emissions you produce when you travel by plane. It doesn't cancel out the emissions you've produced.

For anyone who thinks unbundled RECs are a valuable contribution to combatting climate change, consider their ludicrously low price. Electricity in the US costs about $150/MWh for business users, according to the EIA. You can buy an unbundled REC that lets you claim your electricity's carbon emissions have been canceled out for a few percent of that. The current price of unbundled RECs is about $8/MWh, but a couple of years ago, it was as low as 50 cents per MWh

There are various options within the world of RECs. For instance, bundled RECs are at least purchased from the same producer as the electricity you have used.

However, environmentalists agree that it is better to adopt a scheme that actually pays for new renewable capacity - such as a power purchase agreement (PPA). Under a PPA, a customer pays for the renewable output of either part or an entire energy project such as a solar farm or wind farm.

"Most data center sustainability strategies still focus on renewable energy certificates (RECs)," said energy researcher David Mytton in a 2021 Uptime Institute report. "RECs are now considered low-quality products because they cannot credibly be used to back claims of 100 percent renewable energy use."

He explains: "The problem with RECs is always that when they are unbundled, they become so disconnected from the supply that they can't credibly be used to offset demand."

Mytton suggests operators should use bundled RECs attached to a PPA inside the grid region where they actually use the power: "The further away you get from this, the more it's just paying to continue with what you always did."

Unbundled RECs, he says, are: "A simple and cheap way to greenwash your energy consumption. They are basically meaningless, which is reflected in the price! There's no link between your usage and the renewable energy associated with the unbundled REC."

PPAs also vary

Even within PPAs, there are issues. A 20MW solar farm will not properly match the demand of a 20MW data center. The solar power is intermittent, averaging 20MW, while the data center's demand is continuous, so there will be times when the data center will use fossil energy because the renewable resource is not producing energy at that moment. To properly match energy use, operators should be adopting 24/7 PPAs, which also invest in energy storage, so the grid can hold onto renewable energy and match the operator's energy use hour by hour.

Microsoft, in particular, has been experimenting with 24/7 PPAs in the Netherlands and hopes to extend that fully, as part of its promise to be carbon negative by 2030.

However, this is still experimental and, like much of the company's environmental efforts, is often overestimated.

The company's Sustainability Report for 2021 makes it clear that Microsoft is still using RECs: its renewable energy use includes: "on-site, renewable energy credits, and power purchase agreements (PPAs)."

The report says Microsoft has invested in a total of 8GW of renewable energy PPAs, a figure several times larger than the power it used in the year, which the report suggests is around 1.5GW. Analysts have told DCD that the scale-up may be a sign of Microsoft over-buying to achieve the effect of 24/7 PPAs, but Microsoft told DCD that it buys PPAs in multi-year terms, so much of the capacity paid for in the year is not yet online.

Meanwhile, the report does not say how many RECs Microsoft bought in 2021.. The company has told DCD that it does not break out numbers separately between RECs and PPAs. The report says its REC purchases include "RECs (Green-e certified), guarantees of origin (GO), renewable energy guarantees of origin (REGO), I-RECs, tradable instrument for global renewables (TIGR), J-Credits, large scale energy certificates (LGC) and PowerPlus".

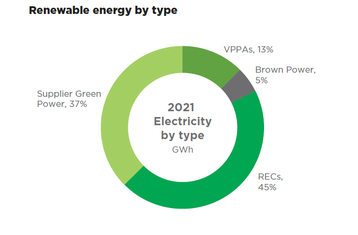

Equinix, on the other hand, included a pie chart (above) in its 2021 sustainability report, which indicates that 45 percent of the company's energy use was matched by RECs, rather than PPAs.

In response to a query from DCD, Bruce Frandsen, director, project and program management at Equinix, explained that Equinix includes unbundled RECs in its portfolio, alongside RECs which are tied to an underlying project: "In some locations unbundled EACs are the only option available, and we choose to do something rather than nothing in these markets."

Frandsen argues that unbundled RECs have a value as a stepping stone, explaining that in some locations the company takes the unbundled RECs and then works to replace them with higher quality solutions that further drive additionality, such as virtual Power Purchase Agreements (vPPAs). .

"While unbundled EACs do not drive the same incremental additionality as vPPAs with new projects, we believe purchasing unbundled certificates plays an important role in sending demand signals to the market.," he says. "For example, in the past few years, prices for unbundled EACs in the US and EU have increased dramatically, a trend we believe is driven by the additional demand from corporate buyers. "

The company favors projects which are less than five years old, which means it is funding newer capacity, and addresses some of Mytton's concerns. Its certificate procurements also align with global certification standards, are Green-e certified in North America, and Equinix adheres to the GHG protocol and ISO 14064-3 reporting standards.

Keep up the pressure

"In summary, Equinix recognizes that not all EACs are viewed as having equal environmental impact and that there is a range in quality for our current renewable energy portfolio," says Frandsen. "However, by doing what we can, where we can, we are supporting the broader renewable energy industry and greening the grid where we operate and beyond for all users."

Given that the shortcomings of RECs are obvious, we'd like to see a robust commitment from across the industry to move away towards more direct funding of the renewable energy it needs.

As always, it will take observant customers to keep service providers up to the mark.