Quantum computing startup IonQ has announced a $2bn merger with a Special Purpose Acquisition Company (SPAC).

The startup has entered into a merger agreement with dMY Technology Group, Inc. III, to become the first publicly traded quantum computing company.

The combined company is expected to be valued at around $2 billion and IonQ shares will trade on the NYSE under “IONQ.”

“This transaction advances IonQ’s mission, to solve critical problems that impact nearly every aspect of society,” said Peter Chapman, CEO & president of IonQ.

“With our key strategic partners, such as Breakthrough Energy Ventures, Hyundai Motor Company, and Kia Corporation, we look forward to leveraging the power of quantum computing in the fight against climate change and to solve vexing problems from materials design to logistics that impact the transportation industry.”

Rumors of the merger were first reported by Bloomberg in February.

“IonQ’s quantum computers are uniquely positioned to capture a market opportunity of approximately $65 billion by 2030,” said Niccolo de Masi, CEO of dMY III. “Quantum computers will create value across thousands of new applications, and IonQ is poised to be the first company able to fully exploit this massive opportunity.”

For more breaking data center news, features, and opinions, be sure to subscribe to DCD's newsletter

IonQ goes public as SPACs & data centers get cosy

SPACs are ‘blank check’ shell companies that list on a stock exchange and then acquire or merge with an operating private company. This route to the stock market is often quicker and involves fewer steps than a traditional IPO.

Until recently, Vertiv’s 2019 IPO was the only major data center-related deal in the SPAC space. However there has been more movement in 2021; last month Cyxtera announced a $3.4 billion merger with the Starboard Value Acquisition Corp SPAC, While CyrusOne’s former CEO and CTO Gary Wojtaszek & Kevin Timmons and former Telecity CEO Michael Tobin are all reportedly joining SPACs.

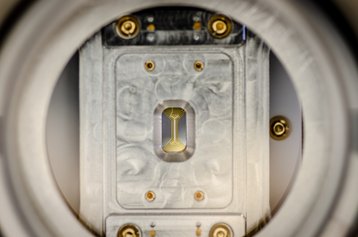

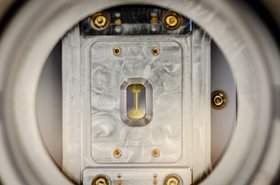

Maryland-based IonQ was founded in 2015 and claims to run the world’s most powerful quantum computer. Its investors include Amazon Web Services, Samsung Catalyst Fund, GV (formerly known as Google Ventures), NEA, Lockheed Martin Corp., Airbus Ventures and Robert Bosch Venture Capital GmbH. The company opened a 23,000 square foot (2,100 sq m) dedicated quantum computing data center in 2020, and plans to have rack-mounted quantum computers by 2023.

dMY's leadership team include Harry L. You as chairman and Niccolo de Masi as CEO. You was previously EVP at EMC and a board member for Broadcom and founded Govtech SPAC GTY Technology Holdings. Meanwhile, de Masi previously led Glu Mobile, consumer IoT company Resideo, and Andy Rubin’s ill-fated Essential.

dMY III raised $300 million in November when it went public and said at the time it would pursue a target in consumer technology. The parent firm's first SPAC merged with mobile betting firm Rush Street Interactive, while the second and fourth SPACs in its portfolio are seeking acquisition targets in the ‘consumer technology ecosystem.'