Across the globe, activity in the Small Modular Reactor (SMR) space is gathering pace. Governments, regulators, atomic agencies and authorities, global power manufacturers, research bodies and new market entrants are busy. For the data center industry, the question is whether SMRs are applicable to the sector? Could they change how data centers are powered?

A look at the output ranges and the different models under development and the different nuclear technologies being proposed as suitable for the sector will tell us more.

The first thing to consider about an SMR is its power output. The International Atomic Energy Agency (IAEA) defines 'small' as under 300 MWe, and up to about 700 MWe as 'medium.'

So, a large data center deployment is at the small end of the SMR market.

There are also developments in the micro modular reactor category. However, most of the recent activity in terms of regulations, licenses and investments has been in the SMR category.

SMRs under development and being built tell a story

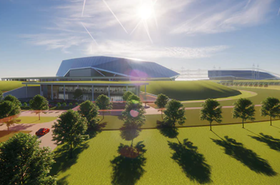

Rolls Royce says its SMR will generate 470MWe. It says a single Rolls-Royce SMR power station will occupy a space the size of two soccer pitches and power approximately one million homes, supporting on-grid electricity and a range of off-grid clean energy solutions.

In January 2023, GE Hitachi announced a contract for its BWRX-300 – a 300MWe water-cooled SMR. According to the company, this is the first commercial contract for a grid-scale SMR in North America.

A Danish outfit called Seaborg is planning floating SMRs using barges that can accommodate 4x 200MWe reactors. It plans to use existing shipyards in which to create a production line for the barges.

In the UK, the Office of Nuclear Regulation is assessing submissions from several firms for the licensing of their technologies. These include US-based Holtec, which submitted its 160MWe pressurized water reactor SMR-160 design developed in collaboration with Mitsubishi Electric of Japan and Hyundai Engineering and Construction of South Korea.

X-Energy, a nuclear reactor and fuel design engineering company, wants to deploy its high-temperature gas reactor in the UK, saying it wants to tackle industrial decarbonization as well as electricity generation. “The Xe-100 can deliver reliable ‘always-on’ electricity,” it says, “as well as increase or decrease power levels safely within minutes to respond to varying demand or supply.”

UK Atomics is a subsidiary of Danish start-up Copenhagen Atomics, which is developing a containerized thorium molten salt reactor. It says its technology is “progressing swiftly with the first non-radioactive full-size reactor prototype to be tested in the UK in 2023.” The company expects deployment by 2028.

For future large data center developments, anyone seeking a clean, reliable, low-carbon producing power generation supply, these systems could be applicable.

Current options to fuel SMRs

The World Nuclear Association (WNA) says there are four main SMR technology options being pursued; “light water reactors, fast neutron reactors, graphite-moderated high-temperature reactors and various kinds of molten salt reactors (MSRs).”

WNA says: ‘Light Water Reactors are moderated and cooled by ordinary water and have the lowest technological risk, being similar to most operating power and naval reactors today.’’

“Fast neutron reactors (FNR) are smaller and simpler than light water types, they have better fuel performance and can have a longer refuelling interval (up to 20 years), but a new safety case needs to be made for them.”

“High-temperature gas-cooled reactors use graphite as a moderator (unless fast neutron type) and either helium, carbon dioxide or nitrogen as primary coolant.”

“Molten salt reactors mostly use molten fluoride salts as primary coolant, at low pressure. Lithium-beryllium fluoride and lithium fluoride salts remain liquid without pressurization up to 1400°C, in marked contrast to a PWR which operates at about 315°C under 150 atmospheres pressure. Fast-spectrum MSRs use chloride salt coolant. In most designs, the fuel is dissolved in the primary coolant, but in some, the fuel is a pebble bed.”

WNA also states many small reactors are being designed for industrial heat applications as well as power generation.

Light water reactors are constrained by pressure limitations and operate in the 300 - 400°C range. Liquid metal fast reactors are in the 400 - 600°C range, molten salt reactors are around 600 - 700°C, and high-temperature reactors are 600 - 900°C.

Possible use cases for SMRs

2022 and 2023 saw a number of large data center development projects in the 200MWe range, many of them in Southeast Asia.

Last year Yondr Group said it would develop a 200MWe hyperscale campus in Malaysia. The company announced a plan to develop 72.8 acres of land in Johor’s Sedenak Tech Park.

T5 Data centers announced the planned development of a 140-acre, 200MWe government and enterprise cloud data center campus in Augusta, Georgia, which it described as the Southeast US cybersecurity hub.

In South Korea, energy and construction firm Bosung Group said it is to build a 200Mwe data center campus in SolaSeaDo, in Jeonnam Province. The company has partnered with The Green Korea (TGK), a joint venture between South Korean energy investment firm Energy Innovation Partners (EIP) and Diode Ventures.

None of these developments has made any announcement on the potential use of nuclear power as a primary power source. Today, the timeframes for SMR production and licensing stretch to 2028 and beyond, so it could be that none of the currently publicized projects can wait that long.

However, things could change quickly.