US mixed-signal semiconductor company MaxLinear said that it was unable to manufacture data center optical and interconnect products due to supply shortages.

The company is fabless, which means it relies on outside chipmaking facilities, in this case primarily United Microelectronics Corporation (UMC). That firm, like other fab companies, have been unable to meet demand, leading to a widespread chip shortage.

"In the optical high speed data center interconnect market, we shipped modest volumes during Q4," cofounder and CEO Kishore Seendripu said in an earnings call transcribed by SeekingAlpha.

"Given the lack of visibility on supply in the near to mid-term, we expect subdued contributions from our 400-gig PAM4 DSP products in the first half of 2022."

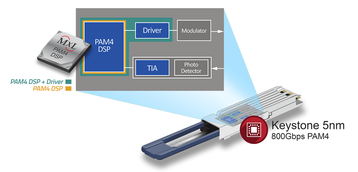

He added: "In the optical data center market, in 2021, we have expanded our portfolio to include TIAs, retimers, and support for active electrical cables. We are also bullish on our position in the 800-gig PAM4 DSPs with our industry-leading first 5-nanometer CMOS Keystone product family."

Seendripu admitted the company's efforts to build market share in the optical data center business was already difficult as a relative newcomer, but said it had opted to skip 200-gig and move to 400-gigabit market.

"And being new to the market, even though we were one of the first ones to get there, we have had challenges getting our share of the market early on, owing to incumbent strength in the data center places," he said. "And then even as we’re getting qualified, we’ve went into supply chain constraints."

Those supply issues are particularly found on the wafer side, CFO Steve Litchfield said. "Substrates are still very challenging out there, and we’re working diligently to get other vendors up and other packaging completed in order to get more product out."

The executives claimed that the company was able to increase its supply better than expected thanks to work by the engineering and operations teams. But, Seendripu warned: "We still have gaps between what our customers need and want versus what we are able to supply. And while we get slow relief, we don’t think we catch up to the full-scale demand, whether it’s connectivity or infrastructure, which are two big growth factors for us.

"I think this is going to be a battle through 2022. But we feel very good that compared to 2021, we as a company will grow pretty substantively."

In its own earnings call, supplier UMC said that supply issues were likely to continue through 2022.

Company president Jason Wang said that UMC anticipates "the demand across all nodes in UMC's addressable market will continue to outpace supply" for the quarter.

He added: "The demand-supply imbalance we have experienced over the past 2 years may find some relief as the new capacity will come online. Yet, it has made clear the need for structural and dramatic transformation in the foundry value chain towards closer cooperation and mutual risk mitigation."