The UK's Competition and Markets Authority (CMA) has approved the proposed $7.3 billion merger of satellite companies Viasat and Inmarsat.

It follows an in-depth probe into the deal, which was first announced back in November 2021.

The potential merger led the CMA to open an investigation into it, with the regulatory body provisionally clearing the merger this March after it held a Phase 2 review into the transaction.

In a statement, the CMA said that the deal raises no concerns and will not harm competition.

"The satellite communications sector is evolving at rapid pace – new companies are entering the market, more satellites are being launched into space, and firms are exploring and entering into new commercial deals. All the evidence has shown that the sector will continue to grow as the demand for satellite connectivity increases," said Richard Feasey, chair of the inquiry group carrying out the Phase 2 review.

"After carefully scrutinizing the deal, we are now satisfied that, following the merger, these developments will ensure that both airlines and their UK customers will continue to benefit from strong competition."

Back in 2021, Viasat said it intended to purchase Inmarsat for $850 million in cash and 46.36 million in shares, then worth $3.1 billion, and to take on $3.4 billion of Inmarsat's new debt.

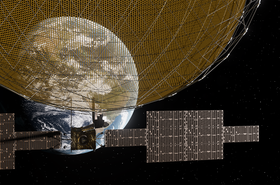

The combined company will have a fleet of 19 satellites in service with an additional 10 spacecraft under construction and planned for launch within the next three years and will operate across the Ka-, L-, and S-bands.

In a joint statement, both Viasat and Inmarsat welcomed the decision, stating it's an important milestone towards the completion of the deal.

The merger has also received approval from Australia and US but is still subject to scrutiny from the European Commission after its Commission’s Directorate-General for Competition referred the proposed acquisition for Phase 2 review.