IBM is set to acquire HashiCorp, a vendor that makes software to help businesses manage digital infrastructure, for $6.4 billion.

Big Blue announced the deal, which is expected to close before the end of the year, on Wednesday, when it reported its Q1 2024 financial results.

It will pay $35 per share for HashiCorp. The company’s stock had been trading at a price of $24.88 before the deal was announced.

HashiCorp's suite of products are designed for infrastructure and security lifecycle management, enabling organizations to automate their hybrid and multi-cloud environments.

Its products include TerraForm, which provides users with a single workflow to provision their cloud, private data center, and SaaS infrastructure and to continuously manage it throughout its lifecycle.

Founded in 2016, HashiCorp listed on Nasdaq in 2021 at an initial valuation of $13 billion. But since then the company’s value has fallen, with revenue growth sluggish, despite an impressive list of clients including Bloomberg, Comcast, Deutsche Bank, GitHub, J.P Morgan Chase, Starbucks and Vodafone.

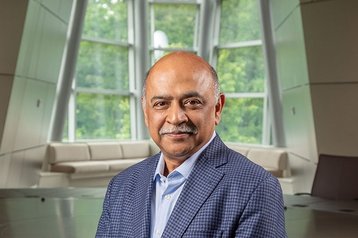

IBM has pivoted away from traditional on-premise infrastructure towards hybrid and multi-cloud packages involving on-prem and cloud infrastructure, and HashiCorp’s software will complement this offering, according to CEO Arvind Krishna.

"Enterprise clients are wrestling with an unprecedented expansion in infrastructure and applications across public and private clouds, as well as on-prem environments,” Krishna said. “The global excitement surrounding generative AI has exacerbated these challenges and CIOs and developers are up against dramatic complexity in their tech strategies.

"HashiCorp has a proven track record of enabling clients to manage the complexity of today's infrastructure and application sprawl. Combining IBM's portfolio and expertise with HashiCorp's capabilities and talent will create a comprehensive hybrid cloud platform designed for the AI era."

Armon Dadgar, HashiCorp co-founder and chief technology officer, said: "Our strategy at its core is about enabling companies to innovate in the cloud, while providing a consistent approach to managing cloud at scale. The need for effective management and automation is critical with the rise of multi-cloud and hybrid cloud, which is being accelerated by today's AI revolution.

“I'm incredibly excited by today's news and to be joining IBM to accelerate HashiCorp's mission and expand access to our products to an even broader set of developers and enterprises."

IBM infrastructure revenue flat

IBM also released its Q1 2024 financial results on Wednesday, which show the business brought in revenue of $14.5 billion in the first three months of the year, up one percent year-on-year.

Income from its infrastructure division was $3.1 billion, 0.7 percent less than in the same period of 2023. Within the division, infrastructure support revenue was down eight percent, while hybrid infrastructure, which includes Zsystems mainframes and distributed infrastructure, grew five percent.

Krishna described the results as “solid” and heralded the growth of the company’s watsonx AI platform. “We continue to capitalize on the excitement and demand for enterprise AI from our clients,” he said. “Our book of business for watsonx and generative AI again showed strong momentum, growing quarter over quarter, and has now eclipsed one billion dollars since we launched watsonx in mid-2023.”