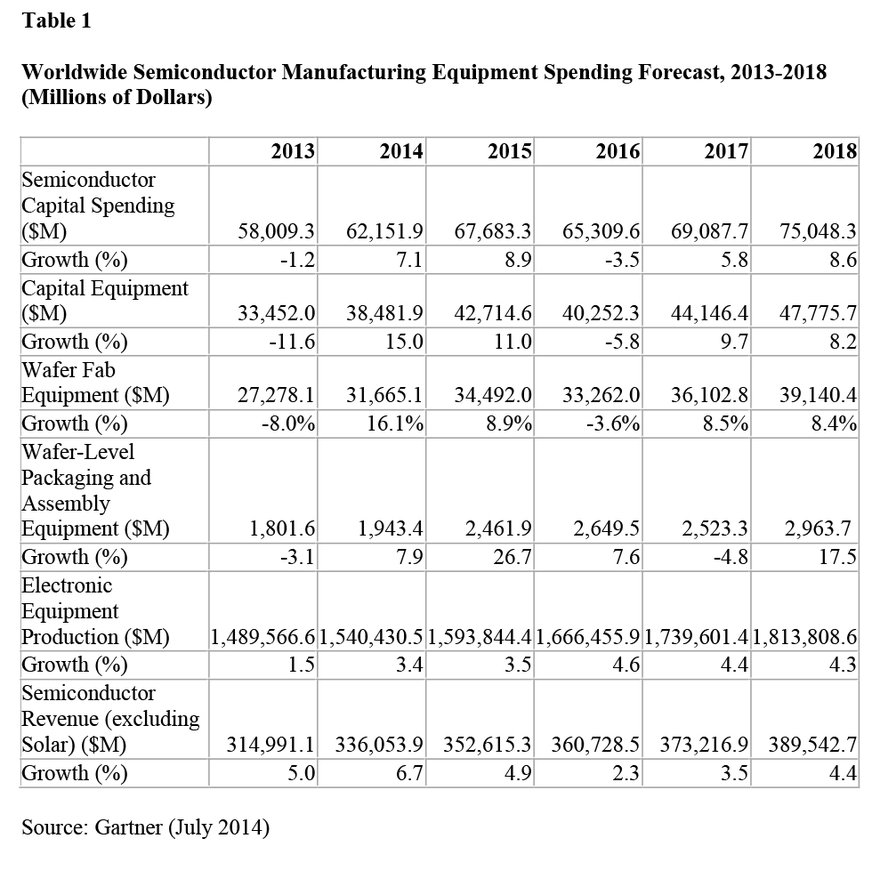

Worldwide semiconductor capital equipment spending is projected to total $38.5bn in 2014, up 15 percent from $33.5bn in 2013, according to analyst company Gartner, Inc.

Capital spending is predicted to rise 7.1 percent in 2014 as the industry begins to recover from the economic downturn and total spending should follow an increasing pattern in all sectors through 2018.

Bob Johnson, research vice president at Gartner said: "While capital spending outperformed wafer fab equipment (WFE) spending in 2013 that is not true for 2014. Total capital spending will grow by 7.1 percent, while WFE will increase 16 percent as manufacturers pull back on new fab construction and concentrate on ramping new capacity instead. Momentum from exceptionally strong fourth-quarter 2013 sales was carried forward through the first quarter, then is expected to bounce around a flat trend line through the remainder of 2014. In the longer-term, growth continues through 2015, dips slightly in 2016 and increases through 2018."

Logic spending remains the key driver of capital spending throughout the forecast period, but due to the anticipated softening of mobile markets it will grow less than memory. Memory will provide most of the growth in capital spending through 2018, with NAND Flash being the primary impetus.

Gartner predicts that 2014 semiconductor capital spending will increase 7.1 percent, followed by 9 percent growth in 2015. The next cyclical decline, it predicts, will be a slight drop of 3.5 percent in 2016, followed by a return to growth in 2017 and 2018.