French critical infrastructure giant Schneider Electric has agreed to merge with British industrial software house Aveva through a complex ‘reverse takeover’ deal.

Schneider will pay £550 million ($855.6m) towards the issue of new shares in Aveva. In return, it will receive a 53.5 percent stake in the company.

The deal is likely to have implications across Schneider’s portfolio of products, including its data center and building management software.

Industrial evolution

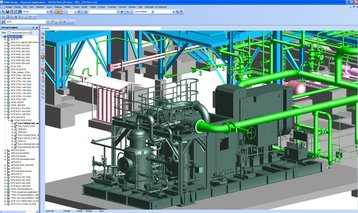

Aveva began its life in 1967 as part of the government-funded Computer-Aided Design Centre at the University of Cambridge. Today, it develops specialist software for oil and gas industry, shipping, warehousing, manufacturing and energy management.

Earlier this year, Aveva partnered with EMC to release an integrated software solution for the management and control of engineering data and associated documents.

The deal with Schneider would more than double the size of Aveva, and help diversify its business. The enlarged company would have combined revenues of £534 million.

Among other things, it would take over the management of the former assets of British engineering and IT expert Invensys, bought by Schneider two years ago for a total consideration of £5.5 billion.

Under the terms of the deal, Aveva will retain its listing on the London Stock Exchange and its chief executive Richard Longdon will continue leading the company.

According to Reuters, shares in Aveva jumped to a four-year high following the announcement on Monday. Shares in Schneider Electric were up slightly.

The transaction remains subject to approval of the boards, shareholders and UK regulators. Emerson and General Electric are just some of Schneider’s competitors rumored to be interested in Aveva if the current deal falls through.