SimpliVity, a Westborough, Massachusetts-based start-up that came out of stealth mode in August with an all-in-one IT infrastructure solution, has received its second cash injection in the form of investment from the famous Silicon Valley venture-capital firm Kleiner Perkins Caufiled and Byers (KPCB) and from the two firms that funded its first financing round: Accel Partners and Charles River Ventures.

This time around, the three investors pitched in for a total of US$25m, bringing the overall amount the firm has raised so far to $43m.

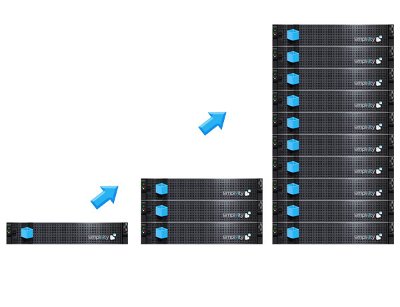

SimpliVity’s product, OmniCube, enables construction of a globally distributed cloud infrastructure by stringing together a series of OmniCube building blocks. Each block has the functionality normally provided by as many as 10 different data center IT products, including compute, storage, network, virtualization platform and more.

IDC analyst Laura DuBois said this all-in-one capability and resource efficiency were two things SimpliVity excelled at. “According to IDC research, customers are moving to converged offerings such as SimpliVity's to increase time to market, improve IT staff efficiency and increase IT resource utilization,” she said.

A minimum deployment is two rack-mounted OmniCubes, each the size of two standard rack units. They create a shared pool of resources that can be scaled by simply adding more OmniCubes.

This type of scaling does both reduce cost and simplify management, according to SimpliVity.

Some of its functionality includes Wide Area Network (WAN) optimization, unified global management, cloud integration, primary and backup storage deduplication, caching and global scale-out.

KPCB, SimpliVity’s latest investor, is an esteemed VC player. It has invested in a long list of successful firms that range from Internet giants like twitter, Zynga, Amazon.com, Facebook and Google to network and IT players like 360 networks, Citrix, Sun and Symantec.