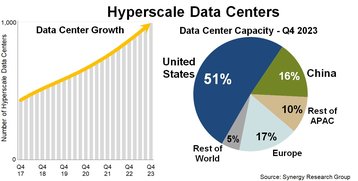

The capacity of hyperscale data centers around the world has doubled in the last four years, according to a report from Synergy Research Group.

A similar growth rate will continue through the next decade amid high demand for cloud services and AI tools, the analyst company said.

Operators scale up for AI

The number of active hyperscale facilities around the world increased to 992 at the end of 2023, Synergy Research Group said, and this number has since surpassed 1,000. The report forecasts an additional 120-130 hyperscale data centers will come online each year over the next decade.

Up to 440 hyperscale data centers are believed to be in the pipeline.

AI will be the primary factor driving capacity growth, the report said. Generative AI will push operators to increase the scale of new data centers, driving up capacity growth.

Many of the biggest property investors in the world to take steps to expand their data center portfolios. In December, Digital Realty launched a $7 billion joint venture with Blackstone to develop more hyperscale capacity, with Blackstone having previously pledged to spend up to $8 billion on its data center subsidiary, QTS, to prepare for the "once in a generation" AI boom.

US ranks first for capacity

In Q4 2023, the US accounted for 51 percent of the worldwide hyperscale data center capacity, with Europe and China accounting for 17 percent and 16 percent, respectively. Northern Virginia, the world's largest data center market, is home to a third of US capacity, despite recent efforts to locate major data centers in a broader geographic footprint.

A recent report by DC Byte said that other areas of the US are likely to see rapid growth include the markets in North and South Carolina, Wisconsin, and Indiana.

Outside the US, the countries offering the most IT capacity include China, Ireland, Germany, the Netherlands, and Australia.

Microsoft, Google, and Amazon account for 60 percent of hyperscale capacity

Synergy Research Group said its data was based on an analysis of the data center footprint of 19 major cloud and Internet service providers.

Perhaps unsurprisingly, the public cloud's market-leading trio - Amazon, Microsoft, and Google - dominate when it comes to data center footprint. The three companies account for 60 percent of all hyperscale data center capacity and are followed in the ranking by Meta, Alibaba, Tencent, Apple, and ByteDance.

The public cloud's 'big three' are likely to drive future growth, too. Last week it was reported that Microsoft intends to double the new data center capacity it brings online this year. Meanwhile, since the turn of the year Google has broken ground on a new development in Norway, and revealed plans for a $1bn data center campus in the UK.

John Dinsdale, chief analyst at Synergy Research Group, said: “Generally speaking, self-owned data centers are much bigger than leased data centers and data centers in the home country of a hyperscale company are much bigger than its international facilities, though there are plenty of exceptions to these trends.”

He added: “We’re also seeing something of a bifurcation in data center scale. While the core data centers are getting ever bigger, there is also an increasing number of relatively smaller data centers being deployed in order to push infrastructure nearer to customers.”