While the Americas remains the global data center market leader, the APAC region saw the strongest growth of live supply from 2018 to 2023, according to a new report.

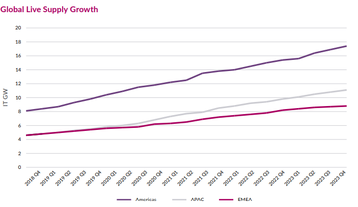

Live supply grew by 20GW globally from 2018 to 2023, DCByte said in its latest global report.

APAC grows, America reigns

The APAC region experienced growth at 19.1 percent CAGR (6.5GW) compared to the Americas, with 16.7 percent (9.3GW), and EMEA with 13.6 percent (4.2GW) between 2018 and 2023.

Developed markets in Australia, China, Japan, and Singapore each contributed over 500MW to the 6.5GW of live supply growth in the APAC region during this time.

Total supply in the APAC region grew from 9GW to 34GW between 2018 and 2021, with the majority of this being committed and early-stage supply.

Early-stage supply, the supply that has been announced but not secured or developed, increased by 68.5 percent CAGR (25.9GW) globally from 2018 to 2023.

APAC ranked first in both growth rates and gross numbers, with India, Malaysia, Australia, and South Korea each contributing over 1GW to growth numbers.

The APAC markets started from a low base market size, however, which has resulted in exponentially high growth rates.

The report said the APAC region is forecasted to grow from 11.1GW total supply in 2023 to 26.7GW by 2028.

According to the report, AI is largely responsible for global growth, particularly with ChatGPT being released in early 2023.

APAC - India and Malaysia lead growth

In the APAC region, India and Malaysia accounted for half of the total 10.5GW increase across all APAC markets.

India added over 2GW of committed and early-stage supply, with 36 projects being more than 50MW, compared to 21 and 23 projects in Australia and Japan respectively.

Early-stage supply growth in India can be attributed to affordable land, greater availability of power, and a highly populous market with a vast insular economy, similar to that of China.

Mumbai is a rapidly emerging market with a total supply of 2.6GW, split between two key clusters in Central Mumbai and Navi Mumbai.

Updates to Maharashtra’s IT policy have incentivized data center development in the city. The city is also expected to add eight new substations with up to 1,500MVA of transmitted power.

Malaysia and South Korea also saw large additions to early-stage supply at 2.1GW and 1GW respectively.

A significant portion of the 1GW early-stage supply in South Korea is years away from development, however, and these underserved markets often lack sufficient power and telecoms infrastructure to support the digital infrastructure.

Johor in Malaysia has been named the fastest-growing market within Southeast Asia with over 1.6GW of total supply. Key clusters include Sedenyak Tech Park, Nusajaya Tech Park, and YTL Green Data Center Park.

According to the report, Johor is a beneficiary of Singapore’s moratorium on data centers in 2019 because of its proximity and government policies.

The CAGR in the Johor region sits at a healthy 222.07 percent in the last three years.

Strong cloud demand in Australia and Japan has led to Osaka and Melbourne emerging as stand-out secondary markets.

Tokyo was named the most established market in the region, with the largest live supply after mainland China. The city has seen steady growth between 2020-2022 with 350-500MW of pipeline supply added each year.

The Americas - Sprawling out of Loudoun County

Virginia remains the largest data center market in the world with more than 4GW of live supply, and plans to more than double that capacity in the future.

75 percent of the live supply in Virginia is housed in Loudoun County, also known as Data Center Alley. However, low vacancy rates have prompted growth in neighboring counties, and almost half of Virginia’s 6GW pipeline supply is located outside of Loudon County.

For example, Prince William County saw the approval of two major campuses in 2023: the Prince William Digital Gateway and Devlin Technology Park.

The US has also seen a boom in the growth of emerging markets. AI and constraints of land and power have seen early-stage supply schemes in North and South Carolina, Wisconsin, and Indiana.

New Albany is one of the emerging markets, and has been named the data center capital of the midwest, because of its affordable land and accessible power.

The region has more than 1GW of capacity under development, tripling the live supply in the area. New Albany also benefits from Central Ohio’s talent pipeline that produces 22,000 graduates a year.

Salt Lake City, Utah, is also an emerging market of interest that has seen several large-scale developments and has access to cheap electricity, attractive tax policies, and strong fiber connectivity.

EMEA - Berlin is a new market to watch

London remained the leading data center market in Europe, standing at 1.2GW of live supply and 2.3GW in pipeline and early-stage supply.

The pipeline supply is mainly concentrated in East London, the docklands, and neighboring counties.

Madrid flourished in 2023, benefiting from connections with a fiber axis spanning from Portugal to Barcelona, affordable land prices, and an increasing supply of green power. Madrid’s pipeline and early-stage supply grew from 13MW in 2018 to over 500MW in 2023. Live supply also more than doubled in the same period.

Spain aims to be run on 74 percent renewable energy by 2023, with this figure increasing to 100 percent by 2050.

Berlin is becoming Germany’s second-largest cloud region after Frankfurt. Due to the affordability of land, the market has surpassed Munich by total supply.

It is expected that Berlin may reach 1GW of total supply in the next two to three years, although there are insufficient funds for the required upgrade to Berlin’s power grid.

Berlin’s demand remains dependent on supply availability, or lack thereof, in Frankfurt.