AI cloud infrastructure company CoreWeave has sold a minority stake in its business.

The $642 million minority investment round was led by Fidelity Management and Research, with a secondary offering from Daniel Gross, Goanna Capital, Investment Management Corporation of Ontario, Jane Street, JPMorgan Asset Management, Nat Friedman, and Zoom Ventures.

Bloomberg reports the company is now valued at $7bn.

Daniel Gross and Nat Friedman also participated in CoreWeave’s Series B funding round, which saw the company raise $221m at a $2bn valuation.

In August, CoreWeave secured a $2.3bn debt financing facility in a funding round that was led by Magnetar Capital and managed by Blackstone Tactical Opportunities. The investment also saw strategic participation from asset management firms Coatue and DigitalBridge Credit, as well as funds and accounts managed by BlackRock, PIMCO, and Carlyle.

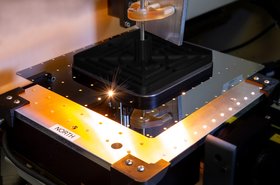

Founded in 2017, CoreWeave started as a crypto-mining company before pivoting its focus to general purpose computing and generative AI hosting. The company now operates as specialized cloud provider, offering access to a range of Nvidia GPUs in the cloud, including H100s, A100s, A40s, and RTX A6000s to support use cases such as machine learning and AI, graphics and rendering, life sciences, and real-time streaming.

"The AI industry is at an inflection point, and CoreWeave has played a central role in powering its evolution by delivering differentiated infrastructure to customers," said CoreWeave co-founder and CEO, Michael Intrator.

"CoreWeave is solving critical issues by integrating the most performant and flexible GPU, networking and storage technologies into the most differentiated AI infrastructure available today. We are building at the pace of AI software adoption."