The Australian Securities Exchange’s enhancements to its algo trading functions and the building out of new data center space helped offset declines in revenue for some business units suffering as a result of the Eurocrisis, the exchange said today.

Dark execution, made possible by the rise of electronic trading, made up about 25% of the ASX’s total trading activity in the last six months.

The ASX made the announcement in its full-year earnings released today.

It follows a year of massive change for the ASX’ trading and data center environment.

ASX managing director and CEO Elmer Funke Kupper said while the ASX has seen a revenue decline in the second half of the year - by 5.1% - its Technical Services, which provides liquidity access, community and connectivity, data center hosting and application services, was up 12.1%.

“In the second half, revenue fell by 5.1% and underlying earnings declined by 8.6%, as both retail and institutional investors reduced their risk appetite and activity levels,” Funke Kupper said.

“This is particularly evident in the businesses that service Australia’s equity markets, including Listing, Cash Markets and Information Services.

“The decline in these businesses was largely offset by revenue gains in Derivatives, Technical Services and Austraclear (the sole Central Securities Depository of Debt Securities in Australia).”

All up, the ASX’s operating revenue for the full year was AU$610m, down 1.2%.

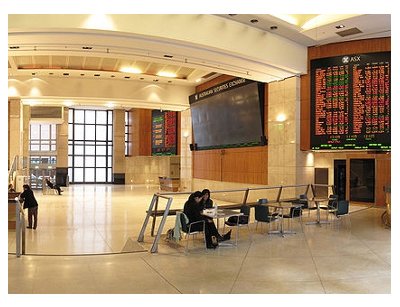

ASX hosting environment

At the time of the announcement, the ASX hosted 59 clients in its new data center, which now offers the market a raft of low latency data products and services to clients and other market operators.

The ASX opened its new data center colocation center in Sydney in February this year.

The data center hosts its own ASX infrastructure and provides colocation space beside its own trading engines for high-speed trading.

It invested AU$32m in the 10,800 sq ft facility but is now leasing out two floors of its three level data center to a Singapore business.

In July this year, the ASX signed a two-way colocation agreement with the Singapore Exchange (SGX) which will see the ASX have a hub placed inside SGX’s data center in Singapore to allow direct connectivity to the ASX 24 futures market.

ASX said its data center, and the introduction of new order types and execution services, has helped the exchange stay competitive in the market, which saw a shift in structure with the introduction of Chi-X, an alternative venue for trading on the top 200 ASX-quoted securities and some electronic trading funds in October 2011.

“The growth in Technical Services is part of ASX’s strategy to adapt the ASX business model to a changing market structure and customer needs,” the ASX said in its earnings release.

“In 2012, the revenue from Technical Services was larger than the revenue from Cash Market trading.”

Technical Services injected $45.3m into the business for the financial year ending 2012. This was compared to $40.4m in FY2011. Information services revenue was $66.9m, down from $70.9m, a reduction it said was due to declining use of retail data use.

Moving forward, the ASX said it would continue to provide input into controls required around High Frequency Trading and dark execution to regulators looking at market structure for equities trading.

The ASX is currently carrying out development and consultation on an equities low-latency order entry service and its global distribution through the Asian SGX hub, and has plans to undertake similar expansion efforts in future.

It is also working on a low-latency data service covering futures.