The data center industry has more than its fair share of men with money. There are giant investment companies everywhere you look, buying and building data center capacity to meet a level of demand that’s gone through the roof.

But who’s the most significant and important right now? It could be Marc Ganzi. He’s CEO of DigitalBridge, a holding company that already manages more than $48 billion worth of digital infrastructure - and has venture capital partners with a seemingly insatiable appetite for more acquisitions.

DigitalBridge manages data center brands including DataBank, EdgePoint, Landmark Dividend, Scala Data Centers, Vantage Data Centers, and more. Switch Data Centers is set to join, soon.

Each month seems to bring new acquisitions so, by the time you read these words, it’s highly likely the company will have more data center space under its control

And it’s all happened in the last eight years.

Modeled on Liberty

“To go from zero to managing $48 billion on a global scale in eight years is hard to even fathom and comprehend,” he tells us.

“Arguably, if you accumulated all of our data centers around the globe, I suspect we're probably the second largest data center operator in the world today. And surely the number of our facilities rivals that of Equinix.”

We meet Ganzi in a gleaming, almost empty office near Victoria, and he starts right in on the modus operandi, and the history that’s led to this massive loosely-knit empire

DigitalBridge is a center of expertise, that spots digital properties with good management and growth potential, and funnels investment into them. He makes it sound simple: “We look at great businesses and great management teams and try to recognize greatness.”

Unlike a lot of data center entrepreneurs, Ganzi comes from a different digital domain, telecoms towers. And he models his company on an icon from yet another sector: Liberty Media, the entertainment and communications company built up by cable TV tycoon John Malone.

By 2013, Ganzi had built up a wireless infrastructure REIT, Global Tower Partners. At that point, he sold GTP for $5 billion, to American Tower Partners, but he wanted to carry on, and address digital infrastructure more broadly.

He recalls: “I had just sold my digital REIT, and I really felt like there was a lot more work to do in the sector. Thankfully, I was correct. There was a lot more work to do. I don't think I quite had envisioned how much.”

Ganzi, and his former GTP colleague Ben Jenkins, looked at John Malone’s Liberty, and asked themselves: “Could someone build the Liberty Media of digital infrastructure?

“I have a great admiration for John Malone at Liberty,” he says. “He has built this incredible holding company that owns a disparate amount of assets around the globe, in media and telecom. He's been an absolute legend for four or five decades.

He goes on: “It was perhaps a bit brazen to suggest in 2013 that Ben and I could create a holding company, with resident expertise in deal making, capital formation, operations, financing, and all the things that are critical to building great companies.”

Skin in the game

A key part of the first stage was for Ganzi and Jenkins to pledge their own capital, from the sale of GTP: “I think in this business, you have to be in the check writing business. When you're managing other people's capital, you have to have conviction around what you're doing.

“Investors want to see that you not only have skin in the game, but that you care. And I think the best way to show you care as an investment manager is to go out and write checks.”

The first investment was Mexico Telecom Partners, which has become the largest independent operator of mobile infrastructure in Mexico.

“In the same year we went on to start Vertical Bridge REIT,” an owner and developer of telecom towers - a follow on to GTP, Ganzi says. “And off we went!”

“Over the first four or five years of the business, we were doing deals without the backstop of a fund,” he said. “We didn't have a fund structure, so it was pretty harrowing having to go out and raise capital, deal by deal, almost in a merchant banking model.”

Over those few years, the group raised about $4 billion of capital, and built six successful brands: Mexico Telecom Partners, Vertical Bridge, network company ExteNet, DataBank, Vantage, and another South American tower company, Andean Telecom Partners. That last one abbreviates to ATP, not to be confused with American Tower Partners, which bought his original REIT.

“All told, we raised about $4 billion of equity, we ended up putting on $4 billion of debt on those businesses. And seven or eight years later, those businesses are marked at about $12 billion today. So we did a really nice job.”

Those first few years were “conservative” he said. “We started the business with a conservative capital structure, backing really good management teams in really good sectors.”

Then, in 2018, they stopped getting funds deal-by-deal. “Five years into the journey, we decided to raise our first fund.”

In 2018, the group raised DigitalBridge Partners 1, a $4 billion dollar fund: “That was quite successful, we did 10 investments out of that.”

Two years later, in 2020, they stepped up: “We began to raise DigitalBridge Partners 2, which ended up being $8.3 billion, so double the size of the first fund.”

Data center expertise

Moving into data centers was planned, and based around expertise: “When we started, we were focused on towers. But in 2013, one of the first operating partners we hired was a guy named Michael Foust.”

Foust was one of the founders and the first CEO of Digital Realty, and Ganzi describes him as “the godfather of the data center industry.”

Ganzi knew Foust in the 1990s, when he was at property firm CB Richard Ellis, and kept in touch when he went to GI Partners to start identifying data center opportunities - a project which eventually spawned Digital Realty, which Ganzi calls “the first data center operator.”

“Michael and I just became good friends,” he says. “And as he ascended and grew Digital Realty, I was growing Global Tower Partners. We always exchanged notes about the similarities and the differences between data centers and towers.”

In 2013 Mike left Digital Realty. “He was on the bench, or more literally on the beach, in California, and I caught up with him and, and said, ‘Gee, why don't you come work with us? We need a partner that understands data centers.’”

As Ganzi tells it, Foust said he had to talk to his wife. The next day he called back, with a greeting from his wife, who said Foust needed to get out of the house and working again.”

Ganzi also brought in Jon Mauck who was CFO of IO Data Centers: “John and Mike have chaired our global data center practice and have done an absolutely brilliant job.”

The data center investments only started in 2016, with DataBank, but Vantage followed quickly. “Besides towers, this is fundamentally our most important practice, and it's gone incredibly well.”

A changing sector

Today’s data center sector has changed, with the pressures of data sovereignty, expanding storage needs, and the arrival of Edge: “The complications of the ecosystem today is far different than it was 20 years ago, when Mike Foust was imagining what Digital Realty was going to look like in 2003.”

Today, data centers are interesting, because “you can't take one big paintbrush and say, ‘this is data centers,’” he says.

“It used to be that we had big colocation data centers, and we had managed cloud services or hybrid IT, which were bought inside of a data center. And that was it. As an industry, we were a one-trick pony,” he remembers.

“Today, you have five very distinct and different businesses,” he says. “You have large public hyperscale campuses; you have large, private cloud hyperscale campuses; you have hyper Edge, which is the 500MW down to 4MW sector that Equinix and DataBank are doing so well; you certainly have enterprise colocation; and then you have managed services.”

These different sectors create “swim lanes” for investors, he says, but it sounds very much like the biggest and fastest moving of these lanes in the hyperscale sector which supports cloud.

“The reality is the opportunity just gets sharper and clearer every day - and it keeps growing,” he says. “Close to $200 billion of capex will be spent this year on cloud infrastructure. So data center spend on a global scale has never been bigger than it is today.”

This is because “data begets data” he says, with high-powered applications creating more data that needs to be stored.

To REIT or not to REIT?

A lot of data center companies have formed as real estate investment trusts (REITs), which confers tax advantages, but DigitalBridge this year converted from a REIT to a conventional company or C-Corp.

The concept has almost universal acceptance, but this year, investor and iconoclast Jim Chanos, famed for short-selling stock, announced he would bet against REITs.

So far, the data center ecosystem has declined to comment on Chanos’ statements. Our view is that Chanos needs to back up his ideas, and show he understands the industry well enough to issue his prophesy of doom.

Ganzi likewise, declined to comment, but continues to be positive about REITs: “I think a REIT is a great idea,” he says. “I think it's a great idea when a business hits a certain phase in its cycle. I think where Digital Realty is, and Equinix is, they've achieved a size and scale and credibility with public investors. There's a steadiness to their cadence about returning capital and growth.”

While the holding company is no longer a REIT, some of its companies are: “Two of our companies are REITs: Vertical Bridge, is a private REIT, and Vantage is a REIT as well. And DataBank is moving to REIT.” Upcoming acquisition Switch is also a REIT.

Others might follow: “To the extent that we can make other businesses digital REITs, we are in favor of that.”

To operate as a REIT is a balance, he says. “Equinix and Digital Realty really found that nice balance between doing greenfield and mergers and acquisitions, but also divesting of assets at the same time.”

The established REITs sell off older, less attractive facilities, he notes, “recycling capital back into younger next-generation facilities. That makes a lot of sense, because some investors want to pay for the yield and that that was a great trade.”

Selling older properties is sensible: “I think when you're ultimately a steward of other people's capital, you have a burden to return that capital and see that it goes well, so I think I think that’s essential.”

At the top of the data center tree, these people all know each other: “Those guys are great competitors. And candidly, they're friends. I think the world of [Digital CEO] Bill Stein. I think he's absolutely a gem of a nice guy. And I think Charles [Meyers, Equinix CEO] is a really great guy as well.”

Prospects for Switch

We are speaking shortly after DigitalBridge bought US data center operator Switch and took it private, in an $11 billion deal that has yet to close. Some observers balked at that price, which was something like 20 percent more than the then share price.

Ganzi explains this move happened because the stock market was obsessed with cloud stocks, and missed the value of Switch - an operator which deals with private cloud for large enterprises.

Essentially, he felt Switch was worth more as a private company, using long-term venture money to deliver private cloud, than it was as a public company, which had to post good figures each quarter.

“I think Switch is interesting, because it’s a great business that doesn't work as a public story but works as a private story,” explains Ganzi.

“There's a massive amount of growth in private cloud,” he says Ganzi, but the stock market couldn’t see Switch’s differentiation.

“What Rob [Roy, Switch CEO] and his team does is differentiated, in the ecosystem that he's created for corporate users that don't want public cloud, but really want privacy and security and on-demand capacity. It’s a very unique offering. I've looked at every data center business in the world over the last decade. And I find that the Switch model is probably one of the most unique models out there.”

Roy bet against the cloud hype, we suggest: “Not a lot of people understand what Switch is doing,” says Ganzi.

Small companies (like DigitalBridge itself) can get all their IT from the public cloud, but larger organizations need a private cloud, and someone to host it: “There's going to come businesses that do require a private cloud solution, whether it's the US Federal Government, or a banking institution, or a shipping company or an IT services business. Some people don't want to put their workload environments into the public cloud,” he says.

Rob Roy saw other operators chasing public cloud, and “decided to skate to where the puck was not going,” says Ganzi. “He made a conscious decision to focus on a core group of customers that required specialization and required a really tailored approach to their cloud environments. On that basis, he's been incredibly successful. I have a lot of deep respect for him.”

Ganzi likes the quasi-military feel of Switch facilities, labeled with a self-proclaimed “Tier V” resilience standard, and manned by security staff visibly armed with tasers: “Those environments are highly secure environments. When you walk into a Switch data center, it's a very different feel than walking into, a CyrusOne facility, a Digital Realty facility, or even a Vantage facility.”

Switch is operating in a different one of Ganzi’s “swim lanes,” he tells us: “Same geo, different markets. You've got the big part of the circle, public cloud, where Vantage is doing a great job, focused on 5MW to 100MW opportunities. I'd say Switch is next, with private cloud, which is anything from, half a megawatt to 20MW. DataBank is focused on what I call hyper-Edge, chasing half a megawatt to 4MW workloads.

“The market is becoming a lot more tailored and differentiated,” he says. “It’s the same as if you said, Crown Castle does the same thing as American Tower does. They don't, Crown is in the connectivity solutions business and American Tower goes out and provides towers.”

Making the deal work

On the high price he paid for Switch, he says: “Based on first quarter and second quarter leasing results, we're effectively going to pay 27 times [the EBITDA] for that business.”

But he lists Switch’s assets: “A land bank of over 900 acres, 1.3GW of unused capacity, and a pipeline of big customers that need big workloads” and says it’s similar to when DigitalBridge bought Vantage in 2017.

“We paid $1.2 billion for Vantage in 2017 - and everybody looked at me like I had 20 heads. I said: ‘You don't get it. We're backing a great CEO, who has a great product, who has a deep pipeline of opportunity.’”

Like Switch, Vantage had land (in Quincy, Washington and Santa Clara), along with building permits and customers.

“You can take a deal that's expensive, and you can say, ‘look, I understand how to underwrite this. I'm going to start at this entry multiple here, and I'm going to take it down three turns through the leasing pipeline, I'm going to take it down another turn and a half, because we have this expansion land, and then I can take it down another two turns over two years, because I'm going to build this, I'm going to buy that.’

“It requires an intense understanding of the environment, the business, the team, the customers, the markets, the permits,” he says. “We're incredibly thoughtful buyers, and at the end of the day, based on what we had paid and how much EBITDA has been generated at Vantage, we're now into Vantage at a single-digit multiple. That took five years to get there.”

By that same process, he plans to get DigitalBridge’s investment multiple in Switch down to eight to twelve in a period of five years: “And we're going to do that through building and leasing into that 1.3GW of future capacity. We're confident we can double the EBITDA in the next five years.”

That couldn’t happen to a company listed on the stock market, he says: “They have to post figures every quarter. They have to raise capital every quarter, which is painstaking. When you're an infrastructure fund like us, and you have funds that are 11 to 13 years in duration, we can be patient. There's a velocity and a cadence to how we put money to work. And we're not in a rush. Right? This isn't a sprint, this is a marathon run.”

Switch had been expanding internationally through joint ventures in Italy and Thailand, but Supernap Italia was bought by IPI Partners, and Switch Thailand is reportedly for sale, as the company slimmed down for a sale. Could DigitalBridge’s backing revive Switch’s international ambitions?

“I can’t comment on that,” says Ganzi.

High-flying champion

Ask a CEO for their stance on diversity and the environment, and you can predict the response. But Ganzi is unusually eloquent, on some topics

“Here's my philosophy. We have two responsibilities as a corporate citizen. One, we have to endeavor to return the planet in a better condition than we found it. Two, we have to provide a path for every young person that wants to be in digital infrastructure, to have a vocation.”

On his first point, we have to raise a question, as Ganzi uses a private jet, which is probably the most carbon-intensive form of travel available. Private jets like Ganzi’s 20-seat Gulfstream emit two tons of CO2 equivalent per hour of flying time, The actual environmental impact is double that, because of non-CO2 emissions at high altitude.

Environmental sites reckon that works out at more than four times the emissions of a passenger on a regular flight, even if the private jet is full to capacity.

We failed to put the question directly to the man in our interview. Later, his people handed back a no-comment on the issue.

We did find, from the company’s 2022 proxy statement, that DigitalBridge pays part of the costs of the jet which is owned by Ganzi. The board of directors has approved an agreement to reimburse “certain defined fixed costs of any aircraft owned by Mr. Ganzi” based on the number of hours it is used for business purposes, as well as “variable operational costs of business travel on a chartered or private jet.”

The report says: “The company reimbursed Mr. Ganzi $3.0 million in 2021.”

Aside from the money, this means that the emissions of those business flights will need to be included in the company’s carbon footprint, in ESG reports.

Diversity player

The second point is what got him excited. He tells us that DigitalBridge is helping to fund data centers for historically-black colleges and universities.

“It's not about just creating and building a data center. It's also creating a core curriculum with classrooms and teachers that can give young diversity candidates a chance to get the education.”

He’s talking about DigitalBridge’s partnership with ImpactData, a company with a plan to build and operate purpose-built colocation data centers on the campuses of Historically Black Colleges and Universities (HBCUs), backed with integrated learning.

The project will turn students into “the most wanted young employees,” says Ganzi, “because they come with a skill set that's specialized, that's built for the next economy. These young adults will come out of school with hardcore, real digital training. They don't teach that at Harvard. They don't teach it at an Ivy League school.”

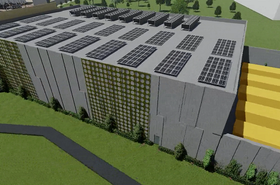

ImpactData appears to be at an early stage of rolling out its data centers, but is clearly a company to watch. The company’s press materials say the DigitalBridge partnership is helping it roll out “Dream Centers” which combine digital learning infrastructure with carrier-neutral colocation.

The company has been given a $500,000 grant to support a Dream Center at Agricultural and Technical State University (A&T), Greensboro North Carolina. The plan is for a 9MW Tier III colocation facility, combined with an innovation center for use by A&T University, along with a lab for workforce training and community engagement.

A&T Chancellor Harold L. Martin Sr. says the project “will allow the university to expand academic and research offerings in high-demand areas, such as cybersecurity and engineering.”

ImpactData says it is investing $100 million in the site over four years, to create 28 permanent jobs, as part of a $1 billion digital infrastructure plan placing similar centers at other HBCUs in markets including Atlanta, Dallas, Houston, Nashville, Birmingham, and Charlotte.

Ganzi mentions the likes of Morehouse College, the alma mater of Martin Luther King, and Samuel L Jackson, but ImpactData doesn’t yet have a project announced there.

It does, however say it has partnered with an ‘influential HBCU in a key southern edge market’ to pilot its Dream Center concept, and partnered with a ‘Global Fortune 100 client’ to consolidate its existing data center assets, while elsewhere promising a “flagship” facility on a “soon-to-be-announced HBCU campus.”

Changing trajectory

Ganzi goes on: “If we can help change the trajectory of a young person's life, man or woman, or otherwise, then we've done something incredibly powerful. We've changed not only their arc, we've changed the narrative. We can help create the great young minds of the digital economy.”

Historically, he says “parts of our youth are told, you're not welcome here. You're not invited. That's rubbish, right? They are invited.”

This is better than getting a good ESG report out, he says: “Anyone can write an ESG report, they put you to sleep. What excites us is that there's hope. And that hope has to come in the form of restoring the planet to where it needs to be, and rekindling the desire in youth to imagine, and to create, and to be the next great digital entrepreneurs.”

DigitalBridge mentors high school students to go to college, and then creates internships and a vocation path for them, before hiring and promoting “great diverse candidates that have the vocation and the experience in digital.”

More than half DigitalBridge’s public board is “diversity and female candidates” he says, and its chair is London-based Nancy Curtin.

“I have the most diverse board of all my peers, and I'm proud of that,” he says.

Appointing Curtin as chair “took a lot of courage, in a very male-dominated digital world” he says, even though she is chief investment officer at an investment firm, Alvarium.

“I deferred being chairman, because I think she's wise, and she has great expertise,” he says.

“In every instance, we've always put the most qualified person in the chair. We just have had the tenacity, and the ability to find the great minds that can help us build this great platform.”