As one of the world’s largest data center companies, Digital Realty has an outsized presence in the data center hotspot of Virginia.

The company has some of the earliest buildings on data center alley, dating back nearly two decades, along with some of the largest, and is building a massive new campus right near Dulles Airport.

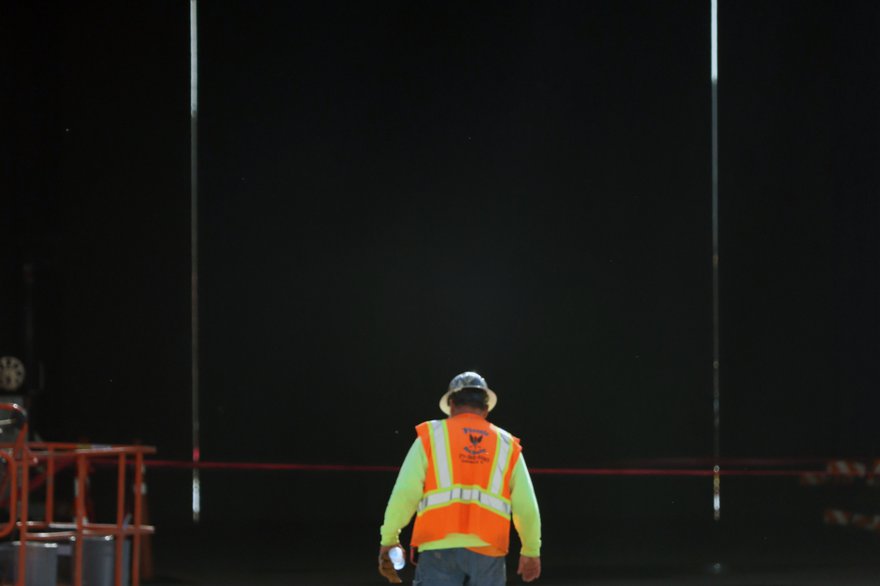

We visited a million-square-foot facility and toured its new construction site to understand Digital’s future in Virginia. “It's such a critical market, not only for Digital, but for the industry overall. It is the gold standard of availability zones on Earth,” company CTO Chris Sharp said.

The company operates around 600MW of IT load in Loudoun today, and is building a new ‘Digital Dulles’ campus that is planned to add another gigawatt on top. “What I think is interesting is we have almost 1,000 acres inside of the Loudoun County area, and 575 acres of that is left to develop,” Sharp said. “There's a lot of runway.”

This feature appeared in the latest issue of the DCD Magazine. Read it for free today.

Its involvement in the county dates back to Digital’s earliest days, when it acquired three data centers starting in 2005. It also built its own, and gained more facilities with the acquisition of DuPont Fabros.

“Once we started development of our campus, we just never stopped,” Rich Becher, design manager at Digital Realty, said. “When I was preparing for this interview, I learned that the first customer we put into that campus is still with us,” he added. “That was a happy thing to learn.”

The company currently has no plans to tear down its older facilities and rebuild them larger and denser. "They still serve their needs," Becher said. "Our customers are happy with them, and are staying in them."

He noted that the components and features of the data centers that age faster are modular, allowing for them to be replaced more frequently than the building itself.

"That modularity is what really allows those buildings to keep up with customers' evolution within them," Sharp added. "It is extremely tedious for these larger deployments to ever lift and shift."

Beyond the size and the number of stories, telling apart the older facilities from the new ones is easy: Just look for windows. “It's funny how that topic has evolved,” Becher said. “In the beginning, we wanted to make the building’s appearance comfortable for our customers - concrete so cars don't get in, and no windows so people don't get in.

“What we're seeing now, and not just in Virginia, is that [local governments] are pushing back on the appearance of the buildings, they don't want these blank wall buildings. So now they have glass on the outside, but you still can’t get in.”

The facility DCD toured, 'Building L' at Round Table Plaza, is built to the company's newest designs, several generations on from the older concrete Virginia sites.

At over one million square feet, it is a huge data center in its own right. "When we were building 'Building L,' one of the crazy things we considered was a moving walkway," Becher admitted. "It's so long that we went to a manufacturer to understand how they work, but ultimately never put it in."

We had to rely on our legs to tour the site, which has a utility power capacity of 120MW. The company's largest in the state, the first customer moved into the data center in October 2017.

"We put our last customer in that building in December of 2020," Becher said proudly. "I think we sold the building faster than we built it."

Developing a single building of that size was a learning moment for the company. “When it launched, we only had one freight elevator, and then we added another one because it was so busy with everybody moving in,” Becher said. “Now any building that gets close to that size will get two freight elevators.”

With Digital Dulles, its huge planned campus adjacent to the airport, Digital Realty is planning smaller individual buildings, but a larger overall footprint. “We have 14 buildings planned on Digital Dulles,” Becher said. “The biggest buildings are larger than half the size of Building L.”

The company hopes that the facilities will represent the next stage of Digital’s life in the data center capital. It also may be the company’s last major land deal in the vicinity. “Believe me, these large blocks of land - there are no more left,” Sharp said. “And, at the size we operate, it was getting upwards of a million to a million-and-a-half per acre inside of this area,” he added, noting that with Digital Dulles they were able to get the land for “around half of that.”

That fundamental land limit will eventually mean the end of the unperturbed growth in Loudoun (delayed somewhat by Dominion’s power issues, which will impact Digital Dulles to an unknown extent). But it doesn’t mean the end of Loudoun as a data center hub - far from it, Sharp argued.

“The largest cloud availability zones on Earth are in this market,” he said. “And what we're seeing now is the adjunct workload that is going to drive more demand over some period of time is artificial intelligence. We see this as being the next epicenter of artificial intelligence, because of the fact that some of the largest data oceans on Earth exist in this market. And you want to do analytics against that.”

Cloud providers don’t want to have fiber repeaters within the same availability zone, so that means operating within 2-12km of another data center to have a “contiguous” or parent/child setup. Sharp envisions high-density data centers for AI workloads close to facilities working on analytics, storage, and other tasks, all operating under a single availability zone.

That requires a lot of interconnection. “Once you build an epicenter, there's a lot of value both in how it's interconnected, and just the efficiencies from the amalgamation of infrastructure and the matchup of customers,” Sharp said.

With Digital Dulles, its meet-me-rooms are much larger than its existing sites, on a percentage basis, “because of the amount of physical fibers and conduits required to run it,” Sharp said, with those fibers connecting to its data centers as well as those of its rivals.

“ServiceFabric is absolutely everything,” he said, referencing the company’s global service orchestration platform. “Because we are open, and so we don't care if your workloads are in another competitor's data center or ours.”

Given the desire for every major company to have an IT presence in Virginia, and the preponderance of potential customers, it is unlike any other market. “There's just some uniqueness with other competitors, it’s more like coopetition,” Sharp said. “Quite frankly, there's more demand than we could ever meet.

“And we don't see that slowing down anytime soon.”