European cloud services provider Interoute says new financial backing will allow it to expand in Europe and the US, by acquiring other firms.

Aleph Capital Partners and Crestview Partners are buying 30 percent of Interoute, for an undisclosed sum. Interoute CEO Gareth Williams has said the changed owndeership will allow the company to expand in Europe and the USA.

Becoming a predator

“This change in the shareholder structure means that instead of being considered potential prey, we can now turn to being one of the predators,” Williams told Reuters.

Aleph and Crestview are buying out existing shareholder Emirates International Telecommunications (EIT), owned by the emir of Dubai. The majority shareholder in Interoute is the Sandoz Family Foundation of Switzerland.

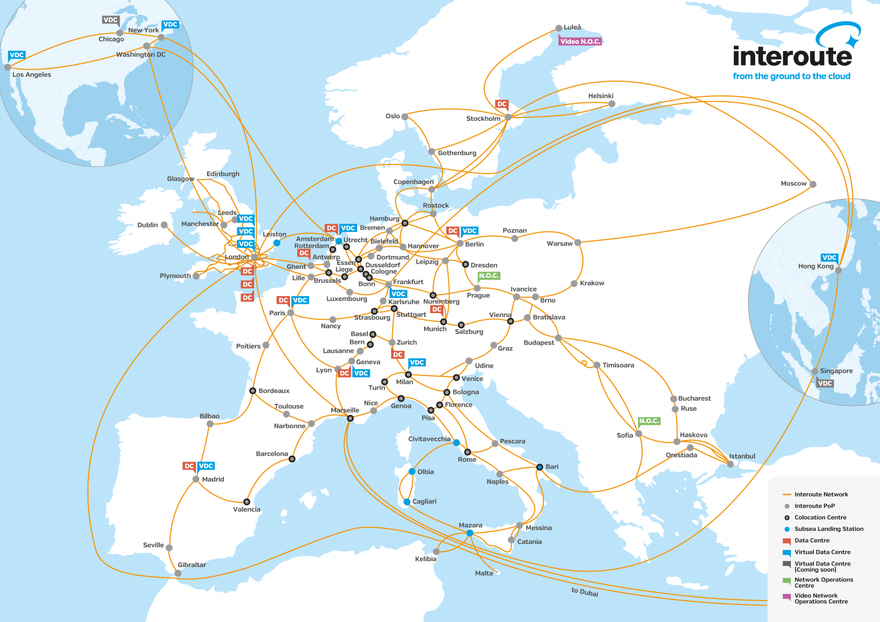

Interoute has 12 data centers in Europe, along with 31 colocation centers and connections to 195 additional third-party data centres, tied up with 67,000km of fibre.

Williams hopes to double revenues in the next five years, and will be looking for firms to buy, which can take the company into new markets or add new abilities.