Semiconductor and wireless networking giant Qualcomm has agreed to acquire Arm chip company Nuvia for $1.4bn.

The company was founded in 2018 by several Apple veterans to target the server market, but Qualcomm says it hopes to use the tech in mobile, IoT, and networking products.

Looking beyond the data center market

"Creating high performance, low-power processors and highly integrated, complex SoCs are part of our DNA," Jim Thompson, Qualcomm's CTO, said.

"Adding Nuvia's deep understanding of high-performance design and integrating Nuvia CPUs with Snapdragon - together with our industry-leading graphics and AI - will take computing performance to a new level and drive new capabilities for products that serve multiple industries."

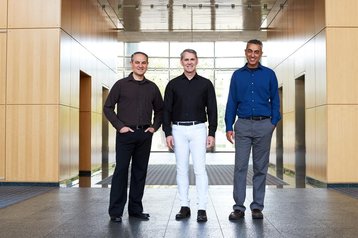

Nuvia founders Gerard Williams III, Manu Gulati, and John Bruno, and their employees will be joining Qualcomm. The three led initiatives including Apple’s A-series of chips that power the iPhone and iPad.

In late 2019, Apple sued Gerard Williams III, claiming that he "exploited" his high position to "secretly" work on his own company. Williams countered that Apple was trying to suffocate the creation of new technologies. In pre-trial hearings, Apple won two motions, while Williams won one. The case is still ongoing, and no trial date has been set. Apple has not sued Nuvia, and does not claim intellectual property theft.

"CPU performance leadership will be critical in defining and delivering on the next era of computing innovation," Nuvia CEO Williams said today.

"The combination of Nuvia and Qualcomm will bring the industry's best engineering talent, technology and resources together to create a new class of high-performance computing platforms that set the bar for our industry. We couldn't be more excited for the opportunities ahead."

Williams also spent 10 years at Arm. Nuvia's chip cores use Arm’s underlying architecture but are custom designs, while Qualcomm mostly licenses cores directly from Arm.

Shifting to Nuvia cores could lower licensing costs, and give it more control over its use of Arm tech - as Arm gets acquired by rival Nvidia.

It is unclear how Nuvia's server roadmap will be impacted, with the company originally planning to compete for the data center market from 2022. Qualcomm previously tried to enter the Arm server market with the well-received Centriq 2400, but laid off its Arm team as it recovered from a failed hostile takeover by Broadcom, and fought its largest customer, Apple, in court.

Since then, however, the Arm server market has grown significantly, with AWS, Ampere, Bamboo, and more proferring Arm hardware. Microsoft, too, is developing its own Arm chips, with staff hired from Qualcomm's Centriq 2400 attempt.

"It's exciting to see Nuvia join the Qualcomm team," Panos Panay, Microsoft's chief product officer, said.

"Our partnership with Qualcomm has always been about providing great experiences on our products. Moving forward, we have an incredible opportunity to empower our customers across the Windows ecosystem."