Edge data centers are generally small data center facilities — designed for IT workloads up to a few hundred kilowatts — that process data closer to the population of local end users and devices. Earlier in 2021, we surveyed data center owners/operators and product and service suppliers to gauge demand and deployments. The findings were consistent: Data center end-user organizations and suppliers alike expect an uptick in edge data center demand in the near term.

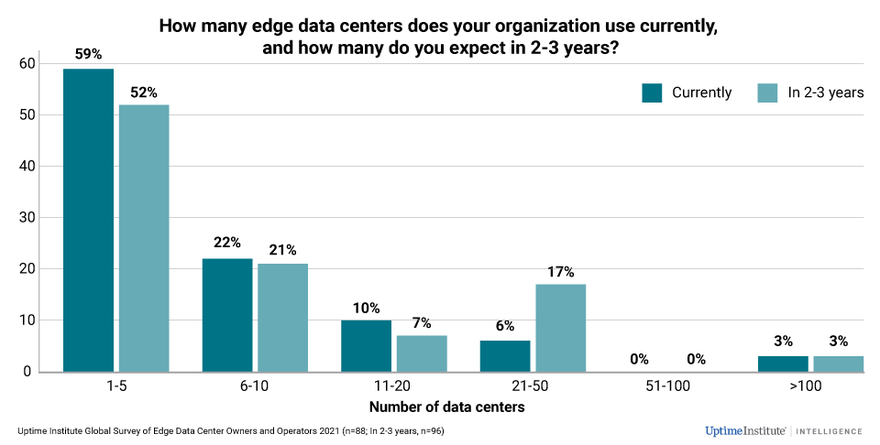

The study suggests that a small majority of owners/operators today use between one and five edge data centers, and that this is unlikely to change in the next two to three years. This is likely an indicator of overall demand for edge computing — most organizations have some requirement for edge, but do not expect this to change significantly in the short term.

Many others, however, do expect growth. The share of owners/operators that do not use any edge data centers drops from 31 percent today to 12 percent in two to three years’ time — indicating a significant increase in owner/operator uptake. Furthermore, the portion of owners/operators in our study using more than 20 edge data centers today is expected to double in the next two to three years (from 9 percent today to 20 percent in two to three years), as shown in Figure 1.

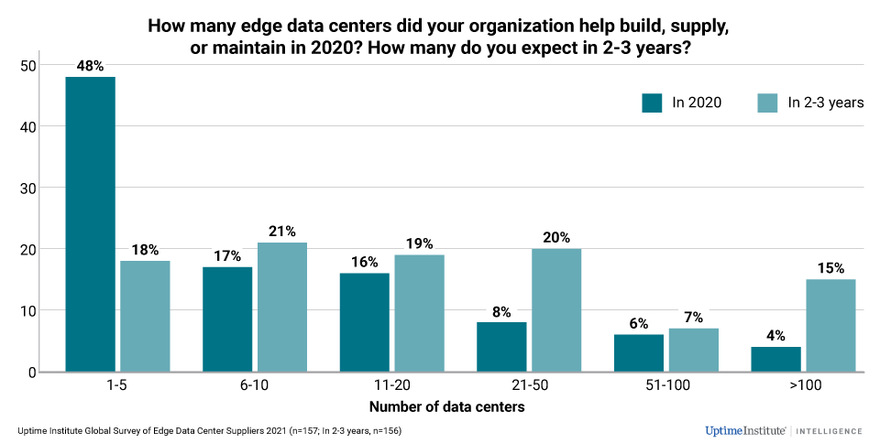

Suppliers in the US and Canada are particularly bullish; almost one in three (32%) expect a yearly volume of more than 100 edge data centers in two to three years’ time. Those in Europe are also optimistic; roughly one-fifth of suppliers (18%) expect an annual volume of more than 100 edge data centers in the coming two to three years. Some suppliers report a recent change in market demand, with orders and tenders going from being sporadic and for a single-digit number of sites, to more requests for larger projects with tens of sites. The change may be attributed to a solidification of clients’ corporate strategy for edge computing.

It seems clear that demand for edge data centers is expected to grow across the world in the near term and especially in North America. Owners, operators and suppliers alike anticipate growth across different industry verticals. The digitization effects of COVID-19, the expansion by big clouds to the edge, and the mostly speculative deployments of 5G are among key factors driving demand. However, there is complexity involved in developing edge business cases and it is not yet clear that any single use case will drive edge data centers in high volumes.

The full report Demand and speculation fuel edge buildout is available here.