Bullish markets are surging with the FTSE close to its record high and the Dow Jones hitting new peaks. As part of our series on technology in the capital markets we recently interviewed some of the key colocation players.

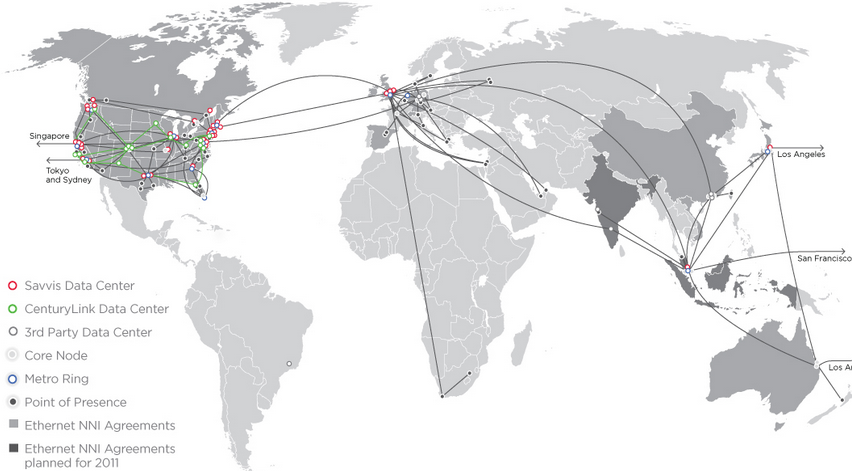

Today is the turn of colocation firm Savvis. Savvis operates data centers in the US and Europe and has a large finanical services customer base. Two years ago Savvis was acquired by US telecoms giant Centurtylink for around $2.5bn.

Roji Oommen, senior director for financial services solutions at Savvis

“Those in the vanguard tend to be very large, then there are many fast followers. The time gap between the large players and those followers has compressed in the last five years. Returns on investment tend to accrue at scale. Within capital markets, even though they opt to deploy big, they can still take advantage of our approach as we operationalize, industrialize and return at scale.”

“Those that want to can take advantage of offerings such as pay-per-use computing with elastic provisioning. Compute liquidity requirements mean banks turning services up and down. This is difficult. The ability of the data center must be to support massively dense computing environments and enabling the tools that build a cloud platform and to bring those to applications with a security context.”

“The network and understanding big data are key enablers. You can use that tech within capital markets – they scale horizontally – you reduce complexity in software but scale in hardware. We’ve been upgrading our backbone and can take application clusters and network via the Wide Area Network enabling the application to grow.”

“High-frequency trading (HFT) is primarily driven by speed. Profits in HFT are plummeting. The guys in the lead are looking at Microwave networking and FPGA compute. The perception that HFT is unfair is a red herring. People get prices and data quicker. You can start an HFT start up as the barriers are relatively low.”

Regulation

“The markets exist to serve a purpose and the regulators know that. And looking internationally the time to market geographically is about low cost and lightprint. Though in some other marketsthe regulatory environment represents a real time risk across the balance sheet.”

The play

“A lot of financial services players are taking a look at computer infrastructure from the perspective of firm-wide risk. As an asset they are taking a strategic view of IT and the trend is to strongly divest of data centers.”

“In sectors like capital markets you need to understand the business and the language. On balance it is most likely that the head of technology at a hedge fund is a trader. We have dedicated sales and marketing teams carved out across capital markets, banking and insurance. We’re religious about infrastructure and we are not an application developer. For many service providers the cost is to deliver a service to fewer traders. By lowering the total cost of the app provision we bring operational scale and give them access to community of the 500 financial firms inside our facilities.”

“We’re really active in dark pools. About half of all dark pool activity takes place in Savvis – we’re the dominant player. We account for 20% of US equity and 40% of global FX. In our view for most firms everything below the app is commoditized. You, Mr Customer, must decide what is appropriate to outsource. Our approach is to give you very flexible tools depending on what you require in the context of a rapidly changing technology landscape.”