According to China’s Ministry of Industry and Information Technology, the country has more than 430,000 data centers holding more than 5m servers. These facilities have a massive demand for cooling capacity and provide enormous opportunities for air conditioners providers.

Some of these firms are entering the country from the outside - and they are finding rich pickings. At the DCD Converged Beijing Event in December, Datacenter Dynamics met Marc Brean, president of the China dvision of Germany’s Stulz, and he told us that China will replace the US to become Stulz’s biggest single market outside Europe.

As a family-owned company, Stulz has manufacturing plants, R&D centers and sales teams in Europe, North America and Asia. However, Brean said Stulz is attaching special importance to the China market among all those markets.

Manufacturing in China

Stulz entered into the china market in the early 1990s. In 2005, Stulz established its first manufacturing plant in China, followed by purchasing another manufacturing plant in 2007.

Currently, Stulz’s cooling solutions have been used in the data centers of Baidu, Alibaba, Industrial and Commercial Bank of China (ICBC) and China Unicom, covering finance, telecom and internet fields. Moreover, it serves many multinational companies operating in China, such as Volkswagen and General Motors.

Marc believes the Chinese market follows the development of the global market. “Like the European and the US market, China’s data center market is firstly driven by the telecom and banking industries, then by the IT and cloud computing industries.”

“If we have a look at the US market, we will find many large cloud data center projects are being constructed now. China also follows the case—as more and more Chinese users use smart phones and tablets for online shopping and online communication, this leads to increasing demand on data processing and storage capacity, and hence large data center projects are rolled out to address the demand.”

Brean points out that China is also following closely global trends in terms of data center cooling. “Five to six years ago, China’s data centers used the direct expansion cooling technology. With the roll-out of more and more large data center projects, chilled water becomes a cheaper option. Under the dual pressure of energy efficiency and carbon control, free cooling will dominate the next stage of development.”

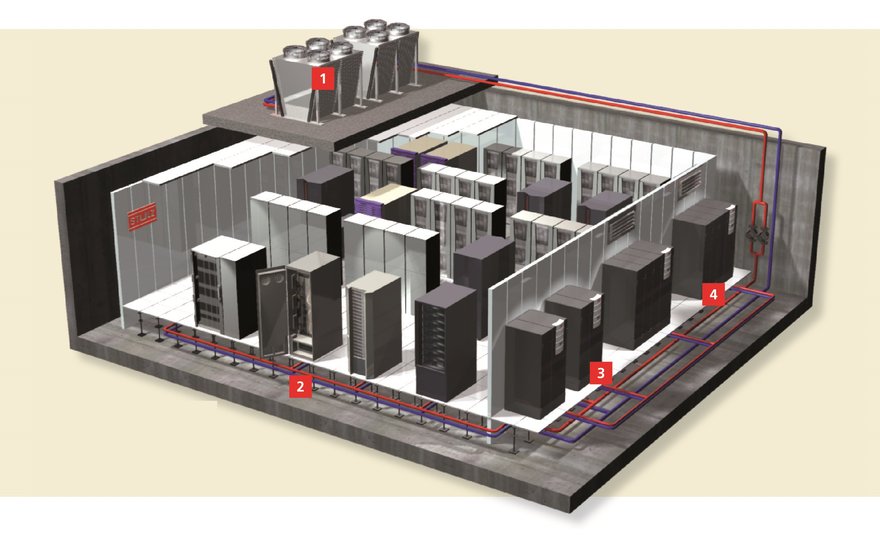

Mixing your cooling tech

Stulz advocates cooling data centers by combining different technologies and solutions. “We don’t have a single solution for a specific region, country or market. It always involves the usage of different cooling solutions, depending on the size, location and prioritized concerns of the project. For example, for the finance industry, security and reliability is very important. However, for the IT industry, it may not have such rigid standard requirements.”

Brean is optimistic about the Chinese market. “China registers a 2 digit growth against the backdrop of global economic slowdown. It is the fastest growing market globally. This conclusion is not only based on our company’s own performance, but also shared by major players within this industry,” he told Datacenter Dynamics.

It is worth mentioning that, though China is a promising market, it is very competitive. Brean said though many Chinese customers still treat price as an important factor for making purchase decisions, Stulz will not lead the “Price War”.

“Every solution has its bottom line for price. Stulz will instead focus on rolling out new technologies and solutions to help customers to reduce their TCO, which has become a very important criterion for them to select products and solutions”, Brean said.

Data centers are estimated to consume three percent of global power, half of which is used to cool data centers. Therefore, apart from the cost of products and solutions, the cost of operating data centers is also becoming a key concern for data center owners and operators.

To meet Chinese customers’ demand for saving energy and reducing carbon emissions, Stulz introduced free cooling technology at a very early stage. “We provide different types of free cooling solutions, including direct cooling and indirect cooling.” He added.

Adapting free cooling

However, China is now suffering from unfavorable weather conditions like the haze. Therefore, along with the introduction of the free cooling technology, Stulz needs to take into account local environmental and weather conditions. “If you look outside, you will find the air (of Beijing) here is not as good as we wished to be. In the US, we can directly use outside air for cooling data centers. However, in china, we may need to filter the air first before it is used to cool data centers,” he said.

Stulz uses local R&D forces to adapt free cooling solutions developed in European laboratories in accordance with China’s environmental conditions to meet local customers’ demand. This solution has been applied to large data center projects in north China where the annual average temperature is relatively low.

“We will continue to invest in the China market, and cooperate with local partners to meet local customers’ demand with our global solutions. We believe China market will soon outpace the US market and become Stulz’s ‘second homeland’ market.” Brean said.