Nuclear power startup Oklo is to go public through a merger with a company set up for the purpose by Sam Altman, chairman of Oklo (and OpenAI co-founder). The deal values Oklo at $850 million, and gives Oklo $500m capital to develop its breeder reactor.

Oklo will merge with AltC Acquisition Corporation, a special purpose acquisition company (SPAC) set up by Altman, along with ex-Citigroup executive, and SPAC player Michael Klein. Being involved with both Oklo and AltC, Altman "recused himself" from negotiations and discussions.

Oklo says it will deploy a working reactor in four years, and will start building its fuel recycling facility in the early 2030s. The company is part of a $6 million project with Argonne National Laboratory to convert spent fuel (i.e. nuclear waste) into fuel for advanced reactors.

Unlike some nuclear startups, Oklo uses fast reactor technology, which can run on recycled fuel from other reactors, adding to the efficiency of the process. Oklo says reactors now consume only about five percent of the energy content in their fuel, the recycling plant would release much of the remaining energy when recycled into new fuel. The recycling plan is considered to be an important part of US energy plans, as it would remove dependence on Russia and other sources of high-concentration uranium nuclear fuel

Oklo plans to produce small reactors, which can sell power directly to customers under long-term contracts such as power purchase agreements (PPAs).

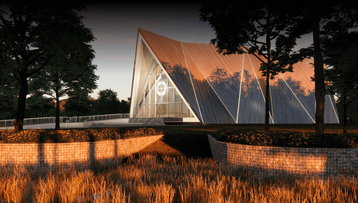

Oklo's Aurora "powerhouse" reactor is a 15MW liquid metal-cooled reactor design that can use fresh fuel or recycled fuel. It is a commercialization of the technology used in the Experimental Breeder Reactor-II which sold power to the grid and recycled waste, from the 1960s to the 1990s, at what is now the Idaho National Laboratory.

Oklo has a site use permit from the US Department of Energy (DOE) and a fuel award from the Idaho National Laboratory (INL) for a commercial-scale advanced fission power plant in Idaho, due to go online in 2026 or 2027. The company aims to build 15MW reactors for less than $60m, and is also planning a 50MW version.

"I think the two most important inputs to a great future are abundant intelligence and abundant energy," said Altman. "I have long been interested in the potential that nuclear energy offers to provide clean, reliable, and affordable energy at great scale.”

Dr. Jacob DeWitte, co-founder and CEO of Oklo, said, “Since founding Oklo in 2013, we have made considerable progress in advancing our vision of transforming how fission technologies come to market and meet the urgent need for affordable, reliable, clean energy. Our long-term goal is to build a wide range of advanced fission power plants, including small and large designs and designs that are economically competitive.

"We have advanced our technology, regulatory engagement, and business model to a critical inflection point, and the substantial capital that we have the opportunity to raise from this transaction will be crucial in positioning Oklo for continued success. As a public company, we believe Oklo will be better positioned to execute its commercial strategy and deliver a differentiated energy solution to a massive market that demands clean energy.”

Footnote: Oklo is named after a region of Gabon where uranium was mined - and where "natural nuclear fission" reactions are known to have taken place billions of years ago. In 1972 researchers noted that the ore from Oklo had a lower concentration of Uranium-235 than naturally occurring ore, along with other fission by-products, showing that fission reactions must have taken place in the pre-Cambrian era, due to the specific geometry of the underground deposit.