Lambda Labs is close to securing $300 million in funding, the Information reports.

Billionaire Thomas Tull, the founder of Legendary Entertainment, is believed to be planning to lead the investment round. SoftBank is also in talks to invest, while Nvidia - which was previously considering investing - is currently not expected to invest.

The funding would value the business at $1.5 billion.

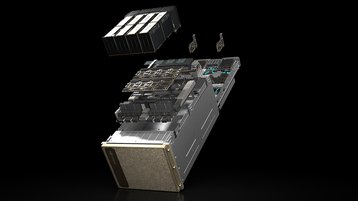

Lambda Labs rents out colocation space in data centers in San Francisco, California, and Allen, Texas, and offers comparatively low-cost GPU-based cloud compute. Alongside the cloud, it offers colocation space and sells GPU desktops.

The company forecasts revenues of $250m for 2023 and nearly $600m for 2024, amid a surge in demand from the generative AI boom. Along with being cost-competitive to hyperscalers, Lambda was also given preferential access to Nvidia's much sought-after high-end GPUs.

Nvidia gave Lambda and rivals like CoreWeave the latest GPUs ahead of hyperscalers (which are developing their own competing hardware).

CoreWeave, which began as a crypto mining business but pivoted to AI cloud, counts Nvidia as an investor. It is currently trying to sell employee shares at a price that values the company at $7 billion, and expects revenues of $500 million this year, the Information reports.

In June, Microsoft signed a multi-billion dollar deal with CoreWeave to use its compute resources through Azure.