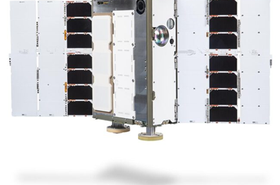

Late on 28 April, Amazon’s Kuiper constellation launched its first 27 satellites aboard a United Launch Alliance Atlas V rocket from Cape Canaveral’s Space Force Station, kicking off its campaign to rival SpaceX’s Starlink solution, serving 4.5 million customers and representing over 60 percent of all satellites in orbit.

The Kuiper Project is intended to represent a 3,236-satellite constellation serving consumers, industry, and governments, as a crucial alternative to Starlink, connecting as many as 300-400 million customers, Andy Jassy, Amazon’s chief executive, said.

A prior launch intended in early April was scrapped due to poor weather, and intended to have half its intended constellation in orbit by July 2025, made impossible by compounding production and launch delays, meaning it will need new permissions from the FCC.

Morgan Stanley has estimated that capital expenditure for the company of the work to begin rollout will exceed $96.4 billion in 2025 alone, and Barclays projects its revenue could represent $61bn by 2030 made up of $26bn in consumer segments and $25bn in business and enterprise including data centers, aviation, and maritime.

“Kuiper is the next big heavyweight to enter the arena,” Caleb Henry, an analyst at Quilty Space, told the Financial Times. “The goal now is to really begin to crank things up, [to] launch regularly and quickly enough to get enough satellites up to start a service.”

The clash of the titans

While Starlink has a great lead and invaluable early success in forming and defining the LEO market, some are sceptical about its longevity.

“While they have a first mover advantage as an ISP using LEO satellites, there will be others that ultimately will give Starlink a run for their money,” Ronald van der Breggen, chief commercial officer at Rivada Space Networks, told DCD. Rivada is a competing satellite network provider operating their 600-satellite-strong LEO Outernet constellation.

“Don't forget that the ISP business is a difficult one where margins are very slim, if positive at all and the projections made by Starlink back in 2019 - to achieve $35 billion in five years - have been missed in a big way,” he said, adding that Kuiper may not benefit from a fast-follower effect. “Kuiper is mostly a me-too product… if differentiation is sought by Kuiper, chances are that it will be in the pricing.”