Power projects seeking to connect to the US grid increased by 27 percent in 2023, according to a report from the Department of Energy's (DOE) Lawrence Berkeley National Laboratory (LBNL).

In total, the report suggests around 2.6TW of planned power projects have joined the interconnect queue - around twice as much as the US's existing generating capacity.

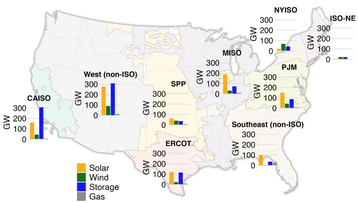

Of those projects, around 95 percent was made up of solar, battery and wind projects. In total, more than 1TW of solar and 1TW of battery storage remain in the interconnection queues.

This is followed by 360GW of wind, and 79GW of gas-fired generation.

The number of new projects joining the queue has continued to ramp up over the years. 2021 saw 561GW join, 2022 had a 759GW increase, and 908GW in 2023.

Of the total 2.6TW awaiting connection, the LBNL report suggests that 311GW have successfully executed interconnection agreements.

The LBNL acknowledges the role that data centers are playing in driving energy demand in the report.

"While total capacity of generators and storage active in interconnection queues provides an indication of longer-term developer interest in grid expansion, it provides less insight into shorter-term resource adequacy concerns related to power plant retirements and/or load growth that is being driven by transport electrification, manufacturing growth, and data centers," said the researchers. "Signed interconnection agreements provide a better understanding of the nearer-term pipeline of project development."

While the vast majority of queued projects are for renewable energy, the LBNL research has found that between 2000 and 2018, only 14 percent of the proposed capacity was actually built. Of the successful projects, 31 percent were for gas power, 20 percent wind, 13 percent solar and 11 percent for battery storage.

Most of the projects awaiting connection to the grid are in the west of the country, with 706GW in the area outside of California, and 523GW with the California Independent System Operator.

The length of time projects take to deploy, from interconnect study to commercial operations, is currently around five years. This has grown from three years in 2015, and two in 2008.

“Decarbonizing the electric sector requires higher levels of installed solar and wind capacity to achieve the same resource adequacy contributions,” the researchers said. “High levels of storage can offset this need to some degree.”

A recent report by McKinsey suggested that data centers and generative AI could see power demand from IT equipment in the US reaching 50GW by 2030. This is up 15GW from the prior year's prediction for the end of the decade.

“What we’re seeing in the market is that these projects are not coming online fast enough to meet the local demand for the data centers,” said Rystad Energy analyst Geoff Hebertson