A planned Connecticut data center powered by 20MW of fuel cells has been granted a $55.2 million sales-tax exemption and other local government support.

The planned Energy Innovation Park (EIP) in New Britain, Hartford County, announced in 2018 by then-Governor Dannel P Malloy, has been exempted from sales tax on IT equipment. It has also been given a long-term contract that allows it to sell electricity from its on-site fuel cells to utilities at an above-market price, according to the Hartford Business Journal.

On-site generation

The ten-year tax break has been approved by The Connecticut Innovations, a public-private entity that provides venture capital and administers investment tax programs. The $55.2 million exemption will be the largest awarded in the ten years since the tax incentive program was conceived, according to Capre Media. It means that the eventual data center operator, and any colocation customers, will not have to pay sales tax on what could amount to hundreds of millions of dollars worth of computer equipment.

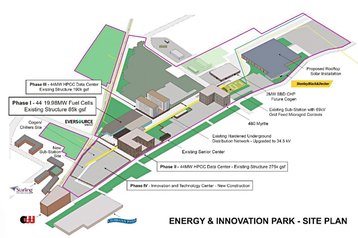

EIP, and its investment partner Thunderbird CHP, plan to build the data center and its associated micro grid in a 465,000 sq ft disused factory on Myrtle Street, formerly used by Stanley Black & Decker.

The facility would use fuel cells from Doosan of South Korea for on-site generation, making it independent of the grid and reliable enough for premium data center customers. The initial plan calls for 20MW of fuel cell power, which could be extended by 44MW according to EIP.

The plan aims to establish Connecticut as a good location for data centers, despite a historic perception that the state has high property taxes and electricity prices.

“The challenge for Connecticut, because we have done so little in the past, is getting up and rolling and becoming a visible, credible location,” University of Connecticut economist Fred Carstensen told the Hartford Business Journal.

Further reading

-

Broadcast DCD>Dallas 2019

-

-

Broadcast DCD>Energy Smart 2020