When Rich Scroggins was growing up, the 21st Century was going to feature robots delivering the mail, jet packs, Jetsons-style flying cars, robot pet dogs and possibly even teleportation.

While the pet dogs as featured in The Jetsons have kind-of emerged, the reality has so far proved disappointingly mundane for anyone who grew up in the 1960s or 1970s.

And yet, a lot has still changed.

Just 20 years ago, the utility computing concept was all the rage: the future would be compute power that could be accessed as easily as electricity – just plug the device into the wall and away you go. What emerged, instead, was cloud computing, which for many users really is plug and play. For example, with cloud gaming via Xbox Live or Nvidia Shield, and TV and streaming videos via the various streaming platforms available today.

But with autonomous vehicles, remote hospital surgery and a tidal wave of AI-powered applications expected to emerge over the next decade or two, the challenge for both Edge and hyperscale data center operators is only going to intensify.

After all, a few dropped packets in a game of Playerunknown’s Battlegrounds is one thing, but when it’s an autonomous vehicle approaching a tricky junction or the surgeon just getting to the most intricate part of remote heart surgery, it could be quite another thing entirely.

Serving these demands today, not to mention the ones set to emerge over the next 20 or 30 years, will place ever-more pressure on data center operators, not just running massive hyperscale data centers, but also Edge data centers built to slash latency, improve service and take a slew of new applications as close to end users as possible.

The last mile

“There’s a whole range of challenges with Edge, in particular,” says Scroggins, Technical Advisor - Data Center Markets, at Cummins.

“That last mile is going to be extremely important for the reduction in latency for critical applications like self-driving vehicles, in the medical field and for the full range of AI-powered services that will emerge over the rest of the decade, because you’re going to need to process much closer to where the data is being used. That’s the emerging value of Edge.”

Scroggins suggests that one manifestation of Edge will look a lot like the cellular communications network, with a proliferation of discrete installations – many of them at base stations – in order to cover the range of applications that will require processing close to the end user.

“It will fundamentally change the data center business on many different levels. For example, maintenance is going to be much more of a challenge, because you’re going to have to send technicians to so many different locations, rather than having a centrally located data center.

“With some of our largest clients at their biggest installations, they have enough backup gensets on-site that we have Cummins technicians who go there every day. Managing the Edge data center of the future is going to be a completely different challenge compared to the challenges data center operators have today,” says Scroggins.

Moreover, he adds, they may have lower levels of redundancy in the expectation that, instead of offering failover features on-site, they will failover to a neighbouring Edge site instead, depending on how mission critical the facility is and the applications it is running. That kind of architecture, after all, is how cellular networks in the US typically operate.

How such an architecture fits with the needs of the various ultra-low latency applications now emerging is one that the industry will have to grapple with over the next few years.

Big issue

But an issue that can be tackled now is how to power and fuel the data centers of the near future, with the next steps to be taken towards genuine sustainability.

Scroggins believes that, in the medium term, hydrogen will have a place, not just in the form of hydrogen fuel cells, but possibly even hydrogen reciprocating engines. Moreover, he believes they won’t just provide backup, in many cases, but could potentially provide on-site generation to run the whole facility. And Edge data centers will be best placed to start.

“When it comes to decarbonization and fuel cells, Edge could be an early adopter because the expense and risk will be lower,” says Scroggins.

This comes down to the current cost of hydrogen fuel storage that, at the moment, is relatively high due to the nature of the element and the challenge of keeping it safely contained.

“The cost and footprint entailed by hydrogen storage for a hyperscale data center would be huge, but if you’re talking about a facility that’s just around 100kW, that cost will be much less daunting,” says Scroggins.

Of course, hydrogen is already used widely in industry for various processes and its production, storage and transportation are, therefore, known quantities.

“A lot of people say that hydrogen isn’t safe. After all, who hasn’t seen pictures of the Hindenburg? But it’s been used safely for a long time. Forklift trucks, for example, run on hydrogen fuel cells. There are international standards already well established for transporting, storing and managing hydrogen. It’s a risk industry around the world is familiar with.

At the moment, the focus of Cummins’ research and development in hydrogen is focused on proton exchange membrane (PEM) via its Accelera new power division.

In terms of hydrogen reciprocating engines, development trails that of hydrogen fuel cells, which have been in development since the 1960s, says Scroggins. “It’s a little bit behind, but manufacturers have, at a small scale, developed engines that run on hydrogen.

“As a fuel, it’s similar to natural gas rather than diesel – spark ignited rather than compression ignited – but because it’s energy density is lower it needs physically larger engines to get the same power out. This is going to present some infrastructural challenges, but I think they can be overcome,” says Scroggins.

In essence, therefore, a technology and market battle will take place between hydrogen fuel cells in their various permutations and reciprocating engines. The key to the outcome of this, believes Scroggins, will be storage.

“We’ve done our technical and economic analyses and project how the costs of the various hydrogen technologies will come down over time. Fuel cells right now are a lot more expensive than diesel gensets, and we expect that gap to close in the coming decades. But we’re not really seeing that for hydrogen storage technologies, so something will have to change there,” says Scroggins.

Hydrogen storage, right now, is both expensive and takes up a lot of space, even for just 24 hours’ fuel for backup. Moreover, it needs to be stored in its gaseous form as storage in a liquid form is both expensive and subject to to boil off. Alternatively – and this is another area that Cummins has been researching – the hydrogen could be stored in a ‘carrier’, such as methanol (chemical formula CH3OH) or ammonia (NH3).

That will add an extra process to extract the hydrogen, first, before it is used in either the fuel cell or the engine, but Scroggins believes it is a highly likely solution to the hydrogen storage challenge. After all, it is not just Cummins that is bidding to make hydrogen work, but companies across the world, such as shipping giant Maersk.

Carbon neutral diesel

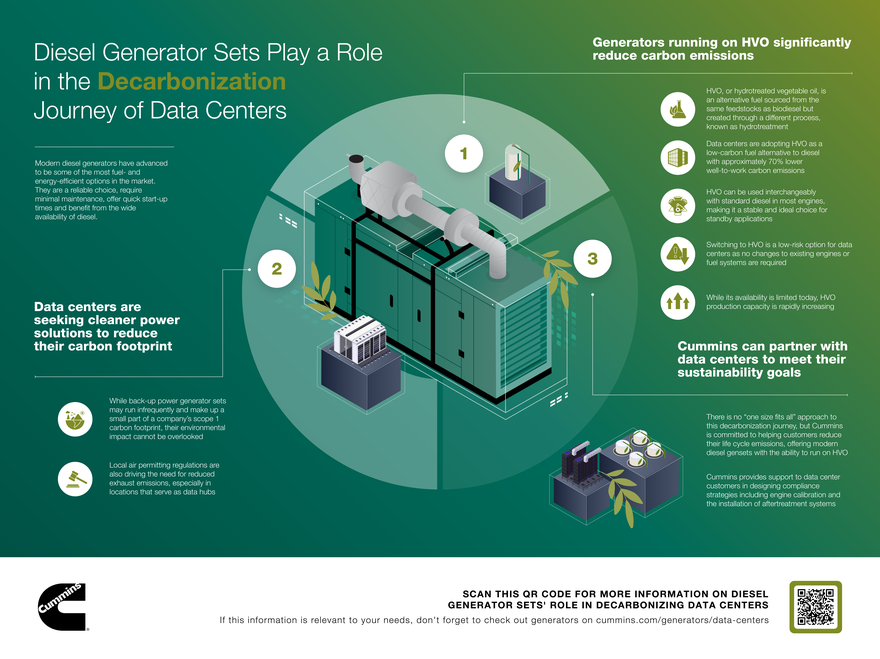

Between now and then, though, with facilities across the world heavily invested in diesel backup, one of the transition fuels will be hydrotreated vegetable oil (HVO), enabling data center operators to make a CO2-reducing next step.

HVO is a diesel fuel made from waste vegetable oil, largely from the food industry, that has been filtered, heat treated and hydrogenated to create a carbon-neutral source of fuel that can run on conventional backup engines from Cummins and others, without any modifications required.

HVO scores over regular diesel in terms of sustainability: it’s not just based on vegetable matter, but waste that would only be discarded.

The one downside is that it doesn’t reduce NOx or some other ‘tail pipe’ emissions, although standard after-treatment systems can reduce these emissions by up to 99 percent, says Scroggins.

“It can be done with no modification to the engine, although there will, potentially be slightly higher fuel consumption and a possible reduction of one-to-two percent of maximum engine power, but generator sets are rarely rated at max engine power. Nevertheless, it’s one of the measures that can be taken without changing any aspect of design – it’s literally a drop-in replacement,” he says.

Live wire

Scroggins believes that, for some time, there won’t necessarily be major changes in the way that data centers are built and operated or refurbished. But we will see significant, incremental changes when the right technologies are ready and make good business sense. However, the shift in power technologies coming in over the next decade or two could see revolutionary changes sweep into the data hall.

“Data centers are certainly serious about their ESG commitments, but they’re not going to put their operations at risk, and the business proposition still has to be reasonable. The hyperscalers are prepared to invest more resources, but it still has to be reasonable from a business perspective.

“I think, therefore, there will be a period of time where you won’t see any big data center design changes.

“When we talk about fuel cells, operators don’t want to change too much inside the building; they don’t want to have to change their electrical distribution. So, at that level there’s strong incentives not to change designs.

“As we look further into the future, at some point if they want to take advantage of new technologies, they may have to make those kinds of compromises. But I think that’s much further in the future. For example, DC distribution. Fuel cells natively produce direct current (DC); batteries produce DC. And so do photovoltaics.

“There’s certainly going to be losses if you’re converting to AC for distribution and then back to DC. So if we look to the future and how we optimize that, DC distribution makes sense. It just doesn’t make sense today because the ecosystem of DC componentry isn’t there, yet, and to take advantage of that you would have to redesign the data halls from scratch to support DC distribution.

“That’s something that the industry isn’t going to want to do rightaway, and certainly not before all the technical elements are in place to support it,” says Scroggins. “It won’t make sense until you can get DC circuit breakers and DC protective relays as easily as you can with AC gear, and the whole infrastructure is broadly available.”

In the near term, therefore, there won’t be many big changes in even greenfield data center designs, but at a certain point in the future the shift to on-site generation, together with a migration to DC electrical architectures will become a key competitive advantage – then, like many of the technology shifts we’ve seen, the momentum will be unstoppable and movement will happen fast.

Closing call to action here. Something like: To find out more about Cummins’ sustainability journey, including HVO, hydrogen fuel cells, planet 2050 and more, go to Cummins’ dedicated data centers website

More...

-

Sponsored How Cummins is driving sustainability across its operations

The data center sector is one of the most demanding in the world. Cummins’ Rich Scroggins tells DCD how data center operators are leading the way towards sustainability and decarbonization

-

Cummins: Genset demand drops, "with the notable exception" of data centers

Plus company faces factory shutdowns

-

Preparing for the hydrogen grid

We have heard how great hydrogen will be as an energy source. But how do you get it?