Riding the wave

There’s been a large upswing in prefab business, even with Covid-19 impacting a ton of business operations, the growth hasn't stopped. Neal says that the advent of March 2020 around global lockdowns demonstrated to many customers the increasing value of pre-fab services, which has had a flow-on effect for much of the data center industry.

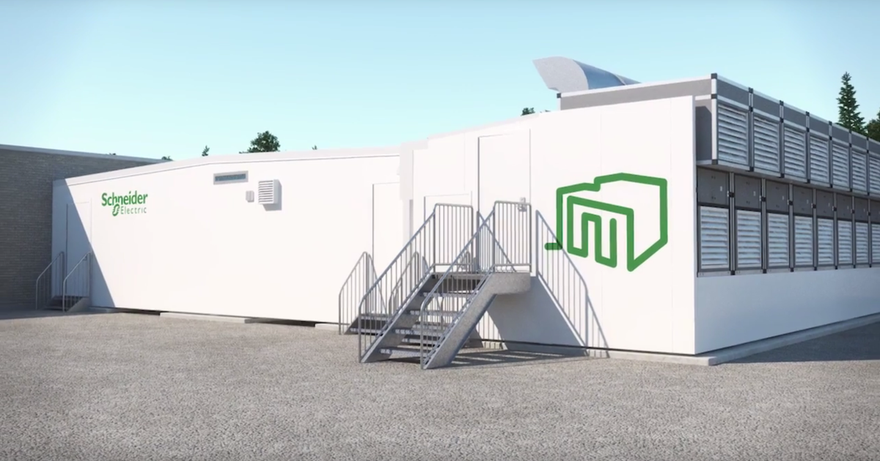

Neal says the products that are offered come in ‘different shapes and sizes,' with complete variation between individual products to suit individual customer needs. This can range from including UPS and power in small solutions, to larger ‘data-hall’ solutions that include racks and cooling systems.

The modular components, or what Schneider refers to as modular rooms, are assembled on-site. This gives customers many advantages, like being able to flex to the building size. There can be a lot of variations as to what is constructed in the factories vs what is delivered on-site. The flexibility of the modular and pre-fab components means they are ideal solutions for customers with variable needs, within even one data center.

The realm of bigger builds

When talking about hyperscalers, their solutions are focused more on the power side. Neal says that hyperscalers prefabricating power solutions are quite common across the board. Even factors like the route to site are taken into consideration when designing and building solutions for clients. In fact, particular highways between factory and destination may impact final design due to transportation requirements.

Neal says there is a continuous evolution in the prefabricated business, with Schneider considering how logistics impact construction and delivery. Being able to effectively mitigate factors like transportation costs is driving them to innovate not only how, but where they manufacture solutions for various clients. One of the main factors driving this innovation is quicker speed to market, i.e., ‘how do we build this faster?’.

Minimizing disruption and minimizing construction work on-site reduces the need for high-complexity projects. Simplifying processes provides benefits in terms of the reduced cost of resources, in terms of materials but also time. There will always be a project, regardless of whether it is prefabricated or not, but Neal says simplification is an important aspect.

Early bird gets the worm

Neal says that when considering value, you have to consider the problem you’re trying to solve. Prefabricated data centers are a ‘tool in the toolbelt’ and shouldn’t necessarily be considered the only way to build new data centers. Where space is a primary concern, simplicity and pre-fab models can make sense in these instances. The difficulty is quantifying the value of space and simplicity, because it ranges from business to business.

Addressing the challenges head-on helps businesses identify specifically what they need, Neal says. Speed can sometimes support these challenges but is definitely not the only factor that needs to be considered when looking at whether pre-fab modules will ‘fix the problem.'

Rockett posits a key question to Neal: how fast is fast? Neal says this depends on the client and the solution. When looking at generally consistent designs across a larger solution, it is easier to develop a manufacturing rhythm. This is because innovation and optimization can occur throughout the deployment process. However, this will generally depend on the project itself.

Closer to the source

One of the strategies Schneider has employed is manufacturing prefabricated modules closer to the clients. Neal says Schneider has set up factories across different regions, and is constantly expanding their manufacturing footprint to help faster delivery of pre-fab products to its customers.

These facilities are supported by even more facilities in regions like South America and China. Ramping up production in these areas means Schneider is continually looking at the supply chain on a global scale. In some cases, Schneider also partners with local suppliers who are already building Schneider products.

Neal says this means they can adapt to customer demands across the globe, optimizing the supply chain process.

Make sure you listen to the free DCD>Talks podcast to find out more about Schneider’s growth in prefabrication and modular build.