DCD recently sat down with Jon Abbott, Technologies Director, Global Telecom Strategic Clients - EMEA, Vertiv, Enrico Rocchetti, Global Portfolio Director, Ericsson & Julian Bright, Senior Analyst, OMDIA, to discuss all things edge and 5G as we move into the next decade.

Edge continues to be one of the most talked about terms in the sector and, as 5G roll-outs continue, there is no doubt they will require further edge compute. While many service providers recognize the major opportunity here, many questions remain unanswered: Who is set to win the mobile edge race? What will it look like? Who will own it, and who will pay for it?

What’s changed over the past 12 months?

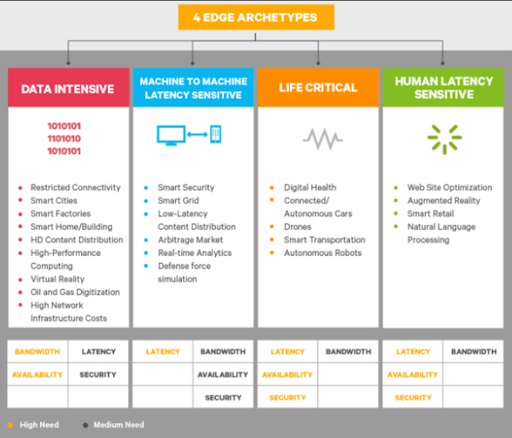

Abbott kicked off the panel discussion by reminding listeners that edge was the mechanism to launch a new generation of services that are dependent upon speed. This requires both a technology change (5G on the radio side, fiber cable deployment, etc) and a location change (physical infrastructure being deployed closer & closer to the end-user). Giving his view on some of the trends we have seen in the edge market over the past 12 months, Abbott referred back to Vertiv’s 4 Edge Archetypes, to outline where most of the evolution has come from.

In terms of data-intensive use-cases, by moving content-delivery closer to the user it is clear that we have seen operational-efficiency gains on the network as less data is sent across it. Similarly, in terms of the human-latency side, immersive retail experiences have also emerged dependent on low-latency localized compute. So we are seeing movement across each of the 4 archetypes.

So how are these shifts perceived by Telcos as we move towards 5G?

CSPs are well placed to become central players in the edge computing market and, indeed, many CSPs are already transforming their networks by moving towards a software-based cloud architecture. As Ericsson’s Rocchetti highlights during the webinar, being at the very early stages of rollout and development, however, although a few Tier 1 providers are pressing ahead at speed, many providers are investigating how edge network architecture

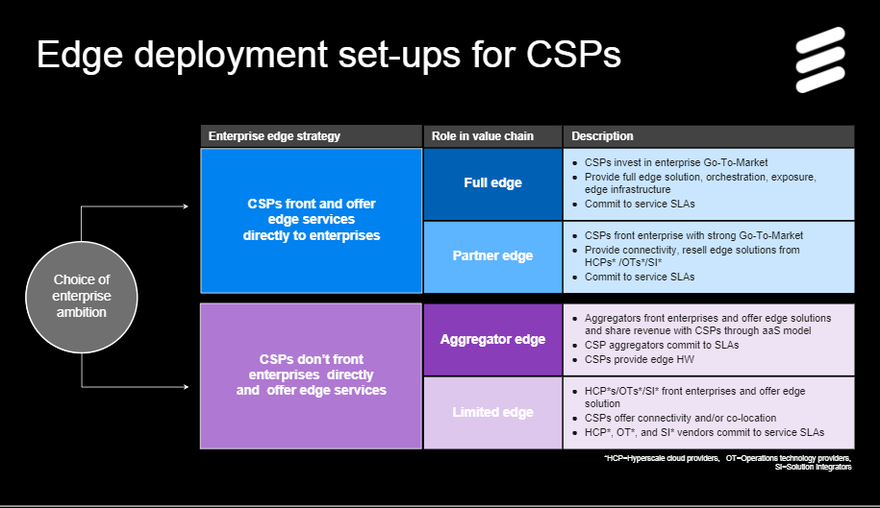

CSPs are well placed to become central players in the edge computing market and, indeed, many CSPs are already transforming their networks by moving towards a software-based cloud architecture. As Ericsson’s Rocchetti highlights during the webinar, being at the very early stages of rollout and development, however, although a few Tier 1 providers are pressing ahead at speed, many providers are investigating how edge network architecture will evolve and are active in finding out what role they might play in this space and how they can monetize it. The panel highlighted that stakeholders and partnerships were evolving fast with considerations including:

- How CSPs can truly monetize enhanced low-latency performance

- Do edge services build revenues for telcos or simply eat into existing revenue streams?

- Who owns the customer relationships?

It is clear, however, they will be a key stakeholder as more processing moves towards the edge in manufacturing, healthcare, and retail. It is also apparent that those who embrace it will have first-mover advantage.

Competition or collaboration?

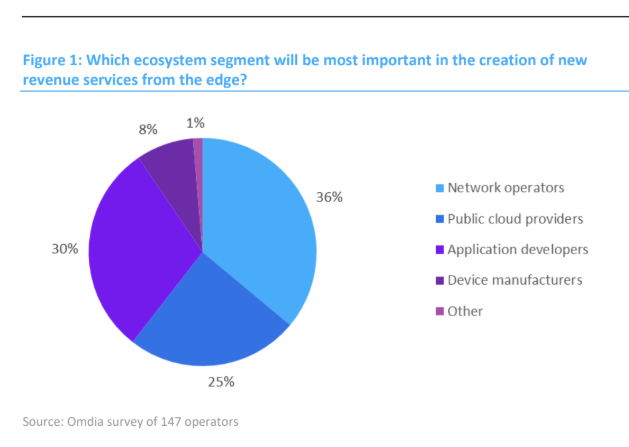

With 5G networks perhaps integral to development at the edge, the panel agreed CSPs are well placed to find successful business models. As OMDIA’s Bright pointed out, hyperscalers such as AWS or Google may look at deployed scaled-down versions of existing hyperscale cloud infrastructure. Similarly, start-up firms are developing metro network infra and large network equipment providers are developing edge services also. Telcos are certainly expecting to collaborate and partner up to deliver successful edge infrastructure. As Rocchetti went on to point out, business models will be varied and are still evolving.

Demand for edge data centers on the rise

As CSPs seek to improve performance across the network, the market for micro and smaller data center deployments similarly increases. Abbott highlighted how the need to deploy across multiple cities and locations means that the design must be repeatable, scalable and easily maintained. Pre-fabricated, modular data centers provide a potential solution for edge deployments as they are quick to deploy, standardized designs, interoperable and mobile.

Indeed, the PMDC market is forecast to grow to $4.3 billion by 2023 with triple-digit growth rates in China, strong growth in US markets and increasing demand from cloud service providers.

As we approach the new decade edge looks set to move from buzz to a reality as use-cases, ecosystems and business models all evolve at an increasing pace.

Watch the full webinar on-demand to find out more.