As the industry doubles down to meet an unprecedented wave of artificial intelligence demand, data center executives are faced with two fundamental questions.

The first is obvious: How do I get in on the action? But the second is harder to answer: How long will it last?

It’s clear that we are in the midst of a frenzied hype cycle, but it’s harder to predict the length of the cycle and where the market will end up.

For Eric Schwartz, CEO of hyperscaler-focused CyrusOne, a form of aggressive moderation is pivotal to success. “Even though we're investing a significant amount of capital, we're very fortunate to have deep relationships with our largest customers who are a major portion of what you were referring to as the hype cycle, but I refer to as the volume growth of the industry.”

Speaking at the company’s London offices, Schwartz said that the close connection to the tech giants allowed it to be “thoughtful about capital so that, however things play out, we will be well positioned to continue to drive growth without finding ourselves overextened.”

He admitted that “everyone's concerned about how much is hype and how much is real,” and noted the previous hype cycles he and others in the company had survived. “But I'm very comfortable that what we're building and investing is tied to the tangible part of [artificial intelligence].”

Schwartz came to CyrusOne after a 16-year stint at Equinix, hoping to bring the same steady growth of the rival data center with him. Now, more than a year into his tenure, he also appears set to bring executive stability to a company that went through four other CEOs in a three-year period.

“We've made a lot of progress in a year, and I'd say it sets us up for a very ambitious trajectory in the future,” he said of the KKR and Global Infrastructure Partners-backed business.

Key to that future is, of course, AI. “It has clearly brought a level of demand, ambition, and opportunity above and beyond what was being discussed and contemplated a year ago,” Schwartz said.

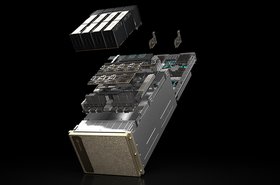

To capture this demand, the company last summer announced ‘Intelliscale,’ a broad brand term for a suite of products that allow the company to support up to 300kW per rack.

Intelliscale uses modular manufacturing and the company's zero-water design, and enables customers to utilize liquid-to-chip cooling technology, rear door heat exchanger cooling systems, and immersion cooling.

Schwartz admits that much of the technology and work on Intelliscale predates him, but “over the past year we have consolidated and synthesized that experience, in conjunction with the dialog we were having with customers about what their future requirements were, and moved that knowledge from a bespoke discussion to an organized and more repeatable and productized model.”

He doesn’t think that most customers will need to go as high as 300kW, but that by setting the benchmark high “it almost takes the density question off of the table.” In the past, he said customers would ask if they supported a density, then a few years later ask for a little more, and a little more.

“I hope what we've accomplished by putting 300kW out there is to say ‘we can support your requirement,’ and then we can get into subsequent discussions.”

Schwartz demurred on sharing what he thinks the AI average rack density will be, citing proprietary agreements and the early days of the deployments.

“But these artificial intelligence and GPU-intense applications do represent a step function in destiny. We used to debate ‘is it four kilowatts per rack, or is it going to be five, six - maybe even eight?’ The discussions have clearly progressed well beyond that.”

This dramatic increase in density, which has been ongoing for years but is now accelerating, is “changing the design principles and ethos of the data center,” he said. Intelliscale represents CyrusOne’s bet on that future.

Denser racks also mean a change to wider facility design due to the limitations on how much power can be brought to the building. CyrusOne expects Intelliscale data centers to be a quarter of the size of traditional ones, depending on the application.

“Even though these are smaller buildings on a relative basis, they're still both large and expensive,” Schwartz said. That is a problem, given the grid limitations data center companies face in much of the world. “This is really a global situation, but requires local solutions, because the solution is very specific to the local conditions.”

For now, CyrusOne is still targeting the same major metros for its AI-focused facilities as for its broader data centers. “It’s incorrect to assume that latency is not a factor for [AI training] data centers,” Schwartz said.

“It’s just a different type of latency to what we've seen in the past: The models currently indicate that their latency optimization is different than what it has been for the Internet, which is proximity to end users. Training models are far more focused on proximity to data and resource.”

That view will evolve over time, as latency elements are better understood and the market matures, but for now CyrusOne continues to invest in the largest markets, “driven by where we can identify the power.”

The company continues to expand in North America and Europe, and in May 2023 entered Japan in a $7 billion joint venture with local energy firm Kansai Electric Power Company (KEPCO).

"There's a lot of resources and presence that KEPCO brings us there that gives us a lot of confidence and enthusiasm for what we can do in Japan," Schwartz said.

Globally, the exec expects the company’s IT capacity to “double over five years, which is a rough growth of 20 percent per year,” he said.

“We could do more than that, but that's the trajectory that we're planning to. And we've been on that trajectory for a couple of years already - before I joined - so it's not a hockey stick. I'm very comfortable in our ability to grow at that level.”

Many of the major players in the market have targeted similar double-digit growth, even as newcomers have flooded into the sector.

“You have to take into account, more so for our competitors than us, but some of the capacity they're deploying is displacing existing capacity with enterprises moving data centers out. But yes, the potential scale of the data center industry will be substantial.”

But, he noted, data centers only exist to support other business activities. “So, assuming the data center industry does get to that size, the technology value that's coming out of it should track right in line. I can remember what the world looked like before the iPhone, and yet now we consider it an indispensable portion of our lives.

“Whether we actually end up with AI appliances or not is sort of secondary to all of the benefits expected to be delivered on that infrastructure.”

As we stand on the cusp of another period of breakneck growth for an industry that expanded manically during the worst of the pandemic, such expectations fill Schwartz with confidence.

“There's always this expectation that things will level off,” he said. “And that just hasn't happened."