The UK Government may scrap the CRC tax and replace it with an alternative environment tax should significiant savings not be made after consultation on simplifying the scheme.

Set out in the country’s annual budget statement was a commitment to “consult on simplifying the CRC Energy Efficiency Scheme to reduce administrative burdens on business.”

“Should very significant administrative savings not be deliverable, the Government will bring forward proposals in autumn 2012 to replace CRC revenues with an alternative environmental tax” the statement said.

It would consult with business before then to identify potential options.

Also in relation to carbon tax it said “allowances sold with respect to 2012–13 emissions will be £12 per tonne of carbon dioxide…the Government will set 2014–15 carbon price support rates equivalent to £9.55 per tonne of carbon dioxide in line with the carbon price floor set out at Budget 2011. The Government will also make a number of additional legislative provisions with effect from 1 April 2013.”

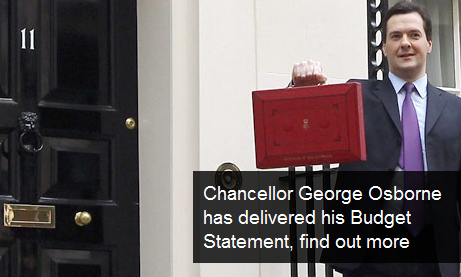

George Osborne, The UK’s Chancellor of the Exchequer, delivered the Budget to the House Commons, saying the UK’s future would be built on industries such as “aerospace, energy, creative media and science,” and that he intended to make the UK “Europe’s technology centre.”

Energy Generation

On energy generation the Government is putting the future in gas saying it would publish a strategy for gas generation in autumn 2012, recognising that gas-fired electricity generation will continue to play a major role in UK energy supplies over the next decade and beyond;

“The Government will launch a call for evidence on barriers to investment in gas generation in advance of publishing a new gas strategy in the autumn to ensure investment in this sector comes forward. This builds on the progress on implementing electricity market reform including the announcements Government has made on how the intended capacity market and Emissions Performance Standard will be implemented to provide certainty to investors in new efficient gas-fired electricity generation.”

Plans for 4GW of energy projects are moving forward after radar interference problems were solved, it said.

Planning

Deregulation and simplification of the planning system will go ahead. “The Government will consult on reducing information requirements and on proposals to amend the Use Class Order and associated permitted development rights, to make changing the use of buildings easier.”

Changes will be implemented by April 2013. In addition new permitted development rights for micro-renewable energy installations will come into force in April 2012.”

Enterprise Zones

Following last year’s creation as an enterpise zone enhanced capital allowances will be available from 1 April 2012 for a designated site in the London Royal Docks Enterprise Zone, .

Also was agreed to make enhanced capital allowances available from 1 April 2012 at designated sites in enterprise areas in Scotland, including Irvine, Nigg and Dundee, and at Deeside in North Wales.

Green Invest Bank

“The Green Investment Bank, which will make its first set of green investments in April 2012; and has introduced further measures including: setting out plans for the Green Deal to support energy efficiency; introducing the Renewable Heat Incentive; providing £1 billion to support the commercialisation of Carbon Capture and Storage; taking forward the Renewables Obligation Banding Review; and developing five new Centres for Offshore Renewable Engineering.”

Elsewhere in the budget statement the government said it would invest £100m in 10 major cities super fast broadband, with £50m invested in extending broadband coverage in smaller cities and towns. It also said it would provide corporation tax relief for technology based industries such as video games and TV.