HP likes Hollywood. Its current CEO once worked at Disney. One of its high profile customers is Dreamworks SKG. It had Dreamworks Animation CEO and Hollywood legend Jeffrey Katzenberg (the K in SKG) address its HP Discover Conference held in Frankfurt last week.

In most, if not all the Dreamworks Animation productions, the plot follows the same basic formula:

A happy, if limited existence is shattered, forcing an unexpected journey of peril which ultimately leads to loss, redemption, a rediscovery of what’s really ‘important’, inner strength and ultimately happiness through love. I’m not sure how much of this maps onto the hp story.

Act II

Here is what we heard during the keynotes at HP Discover Europe 2013 in Frankfurt. There are 9,500 customers and partners attending.

The leading players are HP CEO Margaret (Meg) Whitman, SVP of Systems David (Dave) Donatelli and introducing Jeffrey (Jeff) Katzenberg, CEO of Dreamworks Animation.

Other players with non-speaking (and guest non appearances) are former HP CEO Leo Apotheker who agreed to buy Autonomy from Mike Lynch the former CEO of Autonomy, and the dethroned and exiled king Mark Hurd.

The Conference came just a couple of weeks after Meg Whitman declared on November 20th that the acquisition of Autonomy, the UK analytics software company, required a write-down of $8.8bn dollars on a $11.1bn price due to fraudulent accounting at the software company. Nearly $9bn is a lot of money to write off for a company with a market capitalisation of around $27bn.

The 9,500 people in the Frankfurt audience were really only interested in whether Whitman would address that Elephant in the room during her keynote. She did. Hp is totally committed to Autonomy and its people. Its technology is world beating and there is excitement about its innovation pipeline, she said.

But there weren’t just Elephants in the room, there were also Lions. More about them later.

Whitman’s three pronged message is cloud, information optimisation and security. Whitman clearly wished to position the company as the customer’s friend and herself as a trustworthy custodian.

She said: Firstly, we don’t come with a self-serving agenda. We are open and won’t lock you in. Secondly, we are number one or two in virtually every market we operate in. Thirdly, hp has tremendous foundational assets.

Whitman drew a direct line between herself and the founders of HP by often referring to the company as Hewlett Packard and saying Bill (Hewlett’s) and Dave (Packard’s) DNA remain a key part of the business. The company is about innovation, she said. But it must be more focused on commercialising that innovation and accelerating its time to market.

Why is Whitman naming Security as a key strategic business for hp? Whitman name drops that she is a member of an even more exclusive club than the hp board. Something called the Business Council. It is an invitation only club of a group of global CEOs (mostly US) which meets twice annually. Says Whitman, every one of her peers inside this exclusive club is scared of the infinite potential of mobile and cloud security breaches.

She said she often gets asked: What is hp in the changing world? Whitman said: We can liken what we’re seeing now as transition of similar scale to the transformation from mainframe to client server and from client server to web 1.0 and now from web 1.0 to 2.0. Opportunities abound to redefine the enterprise for the world of mobile, cloud and big data. Hp, she said, will do this without locking customers in to proprietary systems and architectures.

Whitman declares HP is the 10th biggest firm in the US, has more cash flow than Disney, Coca Cola and Fed-Ex – generating $4.1bn in Q4. And its creditors are not banging down the door. It paid them nearly $6bn in the last year.

In the limited time offered in a keynote speech Whitman attempts to tie together all of the disparate parts of HP and present them as a whole.

But how much each of these silos, printers and personal systems, enterprise systems group, enterprise services and finally software understands what is happening inside the other divisions, remains unclear.

Enterprise Systems

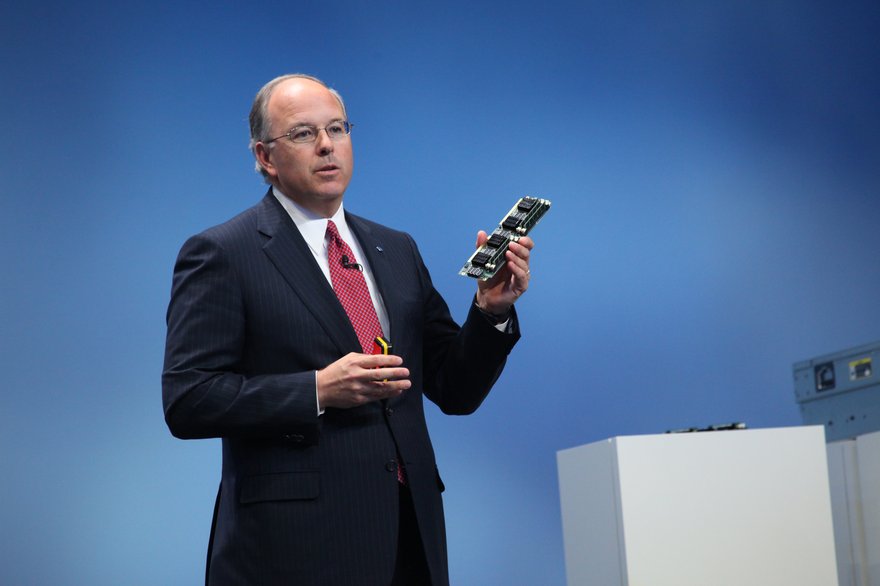

On to the stage comes David (Dave) Donatelli, EVP and GM of enterprise systems group. He hasn’t been given much time to talk, he says.

Dave had joined HP from EMC in April 2009 when HP was run by Mark Hurd. Hurd had been cast into the wilderness after allegations of impropriety. He has since taken up residence as President of Oracle.

Donatelli comes from the enterprise IT world. Whitman hailed from Disney via Yahoo! and eBay. Where she talks about the printer being the bridge between the digital and physical world and about hp stretching from device to enterprise, Dave is firmly from the storage, server, networking and data center space.

He too has three visions: Converged Infrastructure, Cloud – hp converged cloud and the software defined data center.

He says that hp is changing the way servers, storage and networks are designed. ‘I have proof we’re delivering on this,’ he says.

Donatelli is referencing Project Moonshot. This is its ARM and Intel Atom processor based server strategy. This is the first example of mass customisation of the server market, he says, a ‘software defined server category.’ It will use 89% less energy, 94% less space, cost 63% less delivered through 97% less complexity. Expect delivery in mid-2013. He posits the idea of putting ‘thousands of servers in a single rack.’

These server stacks will deliver cloud and hyperscale computing says Donatelli. Running whichever form of cloud you need can be achieved by engaging with hp. Donatelli says while other IT companies force the customer to manage complexity, only hp can deliver the necessary system simplification as the hyperscale and cloud platforms themselves become increasingly complex.

This catalogue mix of cloud and converged infrastructure will deliver simplified agility, he says.

Welcome to Hollywood

The reason Donatelli feels slightly rushed is that Whitman has invited an old friend to speak. Someone from the mythical land of Hollywood.

Jeffrey Katzenberg understands how to manipulate an audience.

He has been one of Hollywood’s most successful wizards for more than 20 years. He also spoke at hp Discover in Las Vegas earlier in 2012.

First he invited incredulity by showing his dumbest moment. The audience is shown a video from 1994 of a press launch for a movie called The Lion King. The video shows him walking onto a stage accompanied by a fully grown male lion.

Katzenberg is holding the lion by a chain and despite the lion snarling and offering him ample warning to back off, he continually annoys it until the lion takes Katzenberg’s thigh and hip into its mouth. Thanks to a professional handler who understood what was happening, the lion released its grip. Katzenberg backed off and lived to tell the tale. ‘Go ahead, laugh,’ he said, it’s funny.’

Mr Katzenberg used this as a metaphor for modern IT. It is a beast which if not treated by trained handlers, will eat you alive.

Dreamworks Animation requires lots of compute power to produce movies. It has had an alliance with hp spanning 12 years – even predating the previous three CEOs. As well as saying that he is testing systems with intel and hp software teams he also endorses Autonomy saying his engineers could not be happier with how it works. Autonomy is being used to analyse unstructured data from Twitter and Facebook to help Dreamworks understand its consumers.

But his purpose is revealed with the lengths he goes to support the current CEO.

Among this endorsements are: “‘Looking at Meg, I couldn’t be more confident about the company’s future.’… ‘I do know a little of what I speak, Meg and I worked at Disney at the same time. In October 2004 Dreamworks went public, one of the first people I contacted was Meg.’… ‘She is a rare leader.’… ‘With Meg at the helm, we’ve just scratched the surface.’”

Katzenberg’s loyalty to his friend is commendable. And he doesn’t avoid the obvious question of why HP customers and partners should listen to him, a self-described ‘cartoon guy.’

Dreamworks Animation uses some serious computing. Each of its movies consists of 500m files. It runs its own data centers and when its loads exceed capacity of those facilities it uses hp cloud assets to run that load. (an earlier report from HP Discover Las Vegas which describes Dreamworks’ workloads is here). Katzenberg closes his segment with a plug for his forthcoming productions.

So apart from the glamour factor what does a $120bn revenue corporation gain by receiving an endorsement from a film studio with 2012 Q3 financials $186.3m revenue and net income of $24.4m.

It was as much about the CEO as about the company.

Dreams work

This brings us to what is happening inside hp? Whitman has set up the company around four divisions.

Whitman tells us that infrastructure accounts for 70% of hp’s revenues. Of course, this could mean anything from a laptop to a printer to a Gen8 Proliant server to the StoreOnce, StoreAll or StoreServe ranges.

Though not the biggest division (see numbers below), the messages appear to point to it being the Enterprise Systems Group which ties together the printer and personal systems, enterprise services and the software divisions.

The question is where does the future lie? In this market it is easier to convince customers and partners. They have a vested interest and as Whitman says: ‘You want us to win.’

Investors are another matter. Whitman has been CEO since September 2011. The share price was at $28 on October 3rd that year, the day it closed the Autonomy acquisition. Whitman did not initiate the Autonomy deal it completed just 10 days after she took the helm. Today shares are hovering around $14.

The investment analysts and financial press are eyeing hp as a break up candidate. For now Whitman and the hp board are sticking to the view that hp is stronger if kept together.

Her play is that having built eBay and run Yahoo! she understands the customer viewpoint. “When we built ebay we built the church for Easter Sunday,” she said.

It only remains for Whitman to convince the investment world that corporates need an ink to infrastructure and device to data center corporation to provide every aspect of IT. And that she should be at the helm of such an enterprise.

If she succeeds then she will have pulled off the ultimate Hollywood trick of salvaging everything just when things looked at their most sticky.

The third act is just starting.

| HEWLETT-PACKARD COMPANY AND SUBSIDIARIES |

| |||||||||||

| SEGMENT / BUSINESS UNIT INFORMATION |

| |||||||||||

| (In millions) |

| |||||||||||

|

|

|

| ||||||||||

|

| Twelve months ended |

| ||||||||||

|

| October 31, |

| ||||||||||

|

| 2012 |

|

| 2011 |

| |||||||

|

| (Unaudited) |

|

|

|

| |||||||

| Net revenue:(a) |

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

| |||||

|

| Printing and Personal Systems Group(b) |

|

|

|

|

|

|

| ||||

|

|

| Personal Systems |

|

|

|

|

|

|

| |||

|

|

|

| Notebooks | $ | 18,830 |

|

| $ | 21,319 |

| ||

|

|

|

| Desktops |

| 13,888 |

|

|

| 15,260 |

| ||

|

|

|

| Workstations |

| 2,148 |

|

|

| 2,216 |

| ||

|

|

|

| Other |

| 784 |

|

|

| 779 |

| ||

|

|

|

|

| Total Personal Systems |

| 35,650 |

|

|

| 39,574 |

| |

|

|

|

|

|

|

|

|

| |||||

|

|

| Printing |

|

|

|

|

|

|

| |||

|

|

|

| Supplies |

| 16,151 |

|

|

| 17,154 |

| ||

|

|

|

| Commercial Hardware |

| 5,895 |

|

|

| 6,183 |

| ||

|

|

|

| Consumer Hardware |

| 2,441 |

|

|

| 2,839 |

| ||

|

|

|

|

| Total Printing |

| 24,487 |

|

|

| 26,176 |

| |

|

|

|

|

|

| Total Printing and Personal Systems Group |

| 60,137 |

|

|

| 65,750 |

|

|

|

|

|

|

|

|

|

| |||||

|

| Services |

|

|

|

|

|

|

| ||||

|

|

|

| Infrastructure Technology Outsourcing |

| 14,692 |

|

|

| 15,224 |

| ||

|

|

|

| Technology Services |

| 10,463 |

|

|

| 10,542 |

| ||

|

|

|

| Application and Business Services(c) |

| 9,767 |

|

|

| 9,936 |

| ||

|

|

|

|

| Total Services |

| 34,922 |

|

|

| 35,702 |

| |

|

|

|

|

|

|

|

|

| |||||

|

| Enterprise Servers, Storage and Networking |

|

|

|

|

|

|

| ||||

|

|

|

| Industry Standard Servers |

| 12,582 |

|

|

| 13,521 |

| ||

|

|

|

| Storage |

| 3,815 |

|

|

| 4,056 |

| ||

|

|

|

| Business Critical Systems |

| 1,612 |

|

|

| 2,095 |

| ||

|

|

|

| Networking |

| 2,482 |

|

|

| 2,392 |

| ||

|

|

|

|

| Total Enterprise Servers, Storage and Networking |

| 20,491 |

|

|

| 22,064 |

| |

|

|

|

|

|

|

|

|

| |||||

|

| Software |

| 4,060 |

|

|

| 3,367 |

| ||||

|

|

|

|

|

|

|

|

| |||||

|

| HP Financial Services |

| 3,819 |

|

|

| 3,596 |

| ||||

|

|

|

|

|

|

|

|

| |||||

|

| Corporate Investments |

| 108 |

|

|

| 208 |

| ||||

|

|

| Total segments |

| 123,537 |

|

|

| 130,687 |

| |||

|

|

|

|

|

|

|

|

| |||||

|

| Elimination of intersegment net revenue and other |

| (3,180 | ) |

|

| (3,442 | ) | ||||

|

|

|

|

|

|

|

|

| |||||

|

|

| Total HP consolidated net revenue | $ | 120,357 |

|

| $ | 127,245 |

| |||

|

| |||||||||

| HEWLETT-PACKARD COMPANY AND SUBSIDIARIES |

| ||||||||

| SEGMENT INFORMATION |

| ||||||||

| (In millions) |

| ||||||||

|

|

|

|

|

|

| ||||

|

| Twelve months ended |

| |||||||

|

| October 31, |

| |||||||

|

| 2012 |

|

| 2011 |

| ||||

|

| (Unaudited) |

|

|

|

| ||||

| Net revenue:(a) |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

| ||

|

| Personal Systems | $ | 35,650 |

|

| $ | 39,574 |

| |

|

| Printing |

| 24,487 |

|

|

| 26,176 |

| |

|

|

| Total Printing and Personal Systems Group(b) |

| 60,137 |

|

|

| 65,750 |

|

|

| Services |

| 34,922 |

|

|

| 35,702 |

| |

|

| Enterprise Servers, Storage and Networking |

| 20,491 |

|

|

| 22,064 |

| |

|

| Software |

| 4,060 |

|

|

| 3,367 |

| |

|

| HP Financial Services |

| 3,819 |

|

|

| 3,596 |

| |

|

| Corporate Investments |

| 108 |

|

|

| 208 |

| |

|

|

| Total Segments |

| 123,537 |

|

|

| 130,687 |

|

|

| Eliminations of intersegment net revenue and other |

| (3,180 | ) |

|

| (3,442 | ) | |

|

|

|

|

|

|

|

|

| ||

|

|

| Total HP consolidated net revenue | $ | 120,357 |

|

| $ | 127,245 |

|

|

|

|

|

|

|

|

|

| ||

| Earnings before taxes:(a) |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

| ||

|

| Personal Systems | $ | 1,706 |

|

| $ | 2,350 |

| |

|

| Printing |

| 3,585 |

|

|

| 3,927 |

| |

|

|

| Total Printing and Personal Systems Group(b) |

| 5,291 |

|

|

| 6,277 |

|

|

| Services |

| 4,095 |

|

|

| 5,203 |

| |

|

| Enterprise Servers, Storage and Networking |

| 2,132 |

|

|

| 2,997 |

| |

|

| Software |

| 827 |

|

|

| 722 |

| |

|

| HP Financial Services |

| 388 |

|

|

| 348 |

| |

|

| Corporate Investments |

| (238 | ) |

|

| (1,619 | ) | |

|

|

| Total segment earnings from operations |

| 12,495 |

|

|

| 13,928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and unallocated costs and eliminations |

| (790 | ) |

|

| (314 | ) | |

|

| Unallocated costs related to stock-based compensation expense |

| (632 | ) |

|

| (618 | ) | |

|

| Amortization of purchased intangible assets |

| (1,784 | ) |

|

| (1,607 | ) | |

|

| Impairment of goodwill and purchased intangible assets |

| (18,035 | ) |

|

| (885 | ) | |

|

| Restructuring charges |

| (2,266 | ) |

|

| (645 | ) | |

|

| Acquisition-related charges |

| (45 | ) |

|

| (182 | ) | |

|

| Interest and other, net |

| (876 | ) |

|

| (695 | ) | |

|

|

|

|

|

|

|

|

| ||

|

|

| Total HP consolidated (loss) earnings before taxes | $ | (11,933 | ) |

| $ | 8,982 | |