White space deployment

In 2013, the amount of data center white space continued to decline in the UK, although at a slower rate compared with the previous year. The amount of end user data center space which is owned in-house shrank by just over 5% in 2013, compared with a decline of over 10% in 2012. This trend was partly compensated by an increase in the volume of data center space that is outsourced to a specialist provider.

To a large extent, trends in white space deployment reflect developments in the UK economy. Recent decline in the amount of in-house data center space has been highest in the ICT, finance and public administration sectors and reflects the impact of facility consolidation and corporate rationalization, as well as the introduction of ‘space-saving’ IT architectures.

Going into 2014, the UK data center industry is expected to see positive growth in the volume of new white space deployed. The amount of in-house data center space will see positive growth as some organizations expand their data center space and others curtail their recent round of consolidation. However, the growth rate for in-house data center space will be gradual compared with that of outsourced space. By 2016, 28% of all data center space is expected to be outsourced compared with 23% in 2013.

The long-term growth of the UK data center sector partly depends on the country’s ability to offer a favorable environment for inward investment. The UK sector is already one of the world’s largest recipients of external data center investment. However, future growth will depend on the mixture of factors which encourage multinationals to locate there.

Data center power requirements

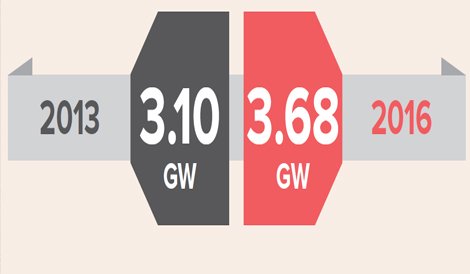

The power requirement of the UK data center industry grew by an estimated 8.8% in 2013 to reach 3.10GW. Total consumption was up from 2.85GW in 2012. The sectors most responsible for driving the growing demand for data center power in the UK are the industry and manufacturing sectors, as well as banking and financial services, healthcare and telecoms and media. Of the total 2013 power requirement, 700MW related to outsourced facilities. This was up from 650MW in 2012.

In the five years to 2016, total power demand from UK data centers is predicted to grow at an average annual rate of 6.4%, with the total requirement now set to reach 3.68GW in 2016. Despite this, the latter part of the decade is likely to see growth start to plateau, as the use of more energy efficient data center technologies becomes more widespread.

Steady growth in the demand for data center power continues to encourage increased monitoring by end users of energy consumption habits. In 2013, 62% of end users monitored energy efficiency on a continuous basis, up from 55% in 2012.

However, despite the increased concern with improving energy efficiency, UK data center operators remain much less concerned about carbon emissions. In 2013, 21.5% of end users said they never monitor carbon emissions, compared with 6.5% who say they never monitor energy efficiency. Moreover, there appears to be little change over the past year in the proportion of end users who monitor carbon emissions on a continuous or occasional basis.

Nevertheless, the UK remains within the top group of countries globally in terms of the percentage of organizations which monitor carbon emissions on either a continuous or occasional basis. Furthermore, over the time the proportion of organizations monitoring carbon emissions is expected to rise. Although concerns about the impact of energy costs on data center operations remain widespread, there appears to have been a change in the degree of end user concern.

When asked about the extent to which energy costs are a concern, 36% of respondents expressed concern that energy costs would significantly impact their data center operations over the next 12 months. This figure was down from 56% of respondents in the 2011 Census. However, the number of respondents who are moderately concerned has risen from 37% in 2011 to 53% in the latest Census. Changes in the degree of concern could reflect improved optimism about the state of the UK economy. It could also reflect the spread of energy monitoring techniques and the use of more energy efficient technologies.