GPU giant Nvidia posted earnings above Wall Street expectations, and said that revenue for the current quarter would be higher than previously predicted.

Revenues across the company were up 256 percent over the same quarter last year, hitting $22.10 billion. Data center-specific revenues, meanwhile, jumped 409 percent to $18.4bn.

Analysts expected Nvidia’s data center unit to record $17.06bn in sales for its fiscal fourth quarter.

The company’s gaming business rose 56 percent to $2.87bn.

The highly anticipated earnings report was seen by many as a bellwether on the state of generative AI, after shares in Nvidia have rocketed beyond Alphabet, Amazon, and the entire Chinese stock market.

Data center sales have increased each quarter - in Q3, revenues hit $14.51 billion, up 279 percent. The quarter before it was $10.32bn, up 171 percent. In Q1, it was $4.28bn, up 14 percent.

In its latest quarter, the company said that more than half of its data center sales came from the largest cloud providers.

However, the company warned that its latest high-end GPUs were likely to remain in short supply.

“We are delighted that the supply of Hopper architecture products is improving,” Nvidia CFO Colette Kress said. “Demand for Hopper remains very strong. We can expect our next generation products to be supply constrained as demand far exceeds supply.”

Nvidia plans to follow up the H100 GPU with the B100 later this year.

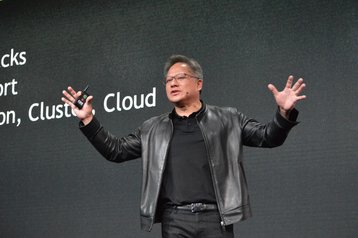

“Accelerated computing and generative AI have hit the tipping point," Jensen Huang, founder and CEO of Nvidia, said. "Demand is surging worldwide across companies, industries and nations.”

Earlier this month, Huang claimed that data center spend was set to go from $1 trillion to $2 trillion in just five years.