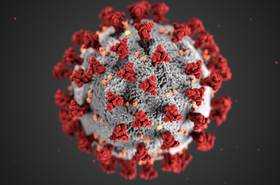

The current Covid-19 pandemic is a threat unlike anything we have faced before.

It will have an untold impact on lives, businesses, and the wider economy. The data center industry is one of the luckier sectors, but will still face significant challenges, financial risks, and an uncertain future.

How will this affect contracts and construction in the US and Europe? DCD spoke to attorneys from Eversheds Sutherland as part of an ongoing series on the impact of coronavirus.

To take part in helping inform this industry about life under Covid-19, get in touch today.

Construction uncertainty

Growth in cloud services is already high and growth has accelerated - particularly for conferencing and messaging. Data center building projects were already under pressure to complete on time. For many of these projects the pressure has increased, while continued construction work is being called in question.

“We've been waiting with bated breath here for governments across Europe to impose restrictions on working on construction sites, and whether that will extend to critical infrastructure,” UK-based Eversheds partner Mark Chester told DCD.

Regulations and restrictions are changing daily, as nations deal with the rapidly evolving situation. When we spoke to Chester, late on March 26, the uncertainty was acute: “We were expecting last night [March 25] in the UK that something might be announced around a cessation of activity on construction sites,” Chester said.

“But it didn't happen. I think the reason it's not happened is because the UK Government is thinking very carefully about some kind of refinements." In other words, the authorities want to define which projects are essential and should be allowed to proceed.

It makes sense to stop work on large scale projects not due until next year or beyond, Chester said, but “stopping contractors attending sites to do installs on data center capacity that can be delivered over the next few months would seem to be a slightly foolhardy thing to do.”

Underlining the spike in demand caused by Covid-19, he said: “One of our hyperscale clients told us earlier this week that they were adding three million new subscribers per day onto their online video conferencing service.”

Given that, hyperscalers are using every ounce of leverage to get capacity: "Any reservations, rights of first refusal, etc, that can possibly be exercised by hyperscalers in third party-operated data centers, where the time horizon for delivery is this year - they're being exercised at the moment.”

Over in North America, “we have construction projects that are continuing,” Rob Plowden, head of the legal firm's US Data Center practice, told DCD.

“My clients that are operators are concerned about ongoing construction projects, they're concerned about how they are going to continue operations when we think we're going to see supplier shortages and material shortages.”

Safety first

All this is happening against a background of actual danger. Construction firms have changed operations protocols to protect on-site staff where possible. They are prepared to negotiate in the face of recommendations to pause, but are well aware that they will have to stop work if given a direct order to do so.

In the case where it’s a government order, contracts may be able to cover some of the costs and delays. Chester said: “If there's a recommendation, well then that's not necessarily a force majeure event, but if the government issues a direction that work has got to stop, construction workers have got to stop whether the building housing development or doing technical fit out on a data center, well then that suddenly becomes a force majeure event.”

A force majeure clause in a construction contract will allow the contractor to suspend work when circumstances arise which are beyond their control. The problem is, a lot of colocation contracts with larger hyperscale customers have a maximum cap on the amount of force majeure delays that can be claimed.

“At one extreme, there is one large global, hyperscaler that imposes just a 24 hour maximum on claimable force majeure events before they can terminate their contracts, versus other more reasonable end users who have a sort of typical 60 to 90 day cap on force majeure extensions.”

But demand from those hyperscale customers is already high, contractors capable of doing the work are scarce, and no one else will be able to step in when a government forbids construction work. Chester believes that it is unlikely that those hyperscalers will exercise those termination rights: “That's like cutting your nose off to spite your face,” he said. “You still need the space as quickly as you can possibly get your mitts on it. And so the last thing you actually want to happen is for the contract to fall over.”

A trickier situation is what happens when a construction site is shut down before a government order. In Clonee, Ireland Facebook and contractor Mace halted work to expand a data center, after workers displayed flu-like symptoms.

Stressing that he was not talking about that specific case, where the decision to halt appears to have been taken jointly, Chester said there could be difficulties in such a situation: “They're in some difficulty from a force majeure perspective, because that's a decision that they have unilaterally made rather than being required to make by local government and so that wouldn't necessarily be a delay event that is permissible under the contract.”

Numerous clients have been contacting Eversheds Sutherland about their contracts, the partners said, to see what is covered. Most data center construction project use standard templates, including AIA in the US, JCT in the UK, VOB in Germany, and FIDIC globally.

“And none of those generic template contracts cover delay events that are due to pandemics - or epidemics for that matter,” Chester said. “Unless they have been specifically amended, which I regard as very unlikely. And so decisions [to delay without a government order] are not generally going to be allowable extensions under that building contract. On the other hand, you would expect a hyperscaler not to want the adverse PR associated with killing their contractor with late delivery.”

“We're relying here on human decency,” Chester added, optimistically. Plus, he said, in the unlikely case it became a legal dispute, “the court is probably going to bend over backwards to help the contractors,” given the magnitude of the pandemic.

The M&A landscape

Covid-19 could also cause delays to large business deals including mergers, acquisitions, and joint ventures that require due diligence. “Due diligence requires travel - and travel has been restricted by the shelter-in-place rules,” Plowden said.

“I am still in a period where we're just getting used to the new normal, but I have definitely seen the brakes have been pumped on due diligence. Deals haven't been terminated, but they have been slowed. I just helped enter into a new contract where, for the first time ever, I've drafted an extension to the due diligence period that relates to delays due to shelter-in-place rules or travel bans.”

Even once restrictions are lifted, there will likely be a backlog, and further delays. Currently, there has been no sign of the price of those potential deals dropping amid economic uncertainty, but that might change.

While overall demand for digital services is rising rapidly, the impact of lockdowns and layoffs means that many businesses will experience a crunch, cutting costs and potentially declaring bankruptcy.

“I'm expecting to see some customers, particularly smaller ones, who are affected by this [ask] for some forbearance,” Plowden said. “In the office and retail sector there has been a lot of forbearance as opposed to a termination. Owners have agreed ‘for the next three months, no rent but after that you'll pay 1.2 times the monthly rent.’”

A similar course of action may be required for some data center customers, although Plowden cautioned that current forbearance strategies are based on an optimism in the US “that the recovery is going to be sharp and fast once this is behind us.”

They might be right, “maybe this is behind us in three, four or so months,” Plowden said. “But in some cases, the optimism that we had a month ago has turned out to be unrealistic" For now, he believes decisions will be informed by this optimism, and not shifting to an expectation of a Great Recession.

Depending on the length and impact of this pandemic, numerous businesses will struggle, ask for forbearance, or default entirely. Bigger data center operators, especially those with hyperscale contracts, will be able to weather this. Smaller firms, operating in one or a few cities with lots of local customers, may not.

“They're more likely to have project-level debt on the facility, and so as you work up the cash flow for the project, there's not enough cash coming in from the customers, not enough cash to pay the lender,” Plowden said. Some of them may themselves be able to get forbearance from lenders, but that will not go on forever.

“As this persists we'll see smaller operators affected in that way I would expect just like any other recession, and then that we would see M&A activity, bargain hunters.”

Such concerns are luckily at least a while off - for now, operators have to focus on the crisis at hand, ensuring that their staff, customers, and facilities are protected.

All non-essential staff should work from home. Those that have to travel in should carry documentation to show they are essential, critical workers, the attorneys said. Even where the local government does not provide specific guidelines on this, it is recommended to play it safe.

“My advice to my clients has been to reach out to their governmental entities,” Plowden said, but admitted that that has become more difficult as the severity of the pandemic grows.

“Two weeks ago, a data center probably could get a letter from the Cybersecurity and Infrastructure Security Agency that confirms that they are critical infrastructure. There's more of a log jam now, I don't think that's the case now.”

Chester found that similar precautions should be taken even when shipping goods. To take one example, Excool adiabatic chillers were being sent from Worcester, UK, to a Frankfurt facility set to be operational in the coming months for a hyperscale customer. “One of my partners did a terrific job, just literally creating letters that were put on the headed notepaper of the data center operator that could be carried by the both the haulage company and the people from Excool, who were traveling with this kit to just make sure that it got there safely - just in case that they were intercepted on the way.

“And indeed it did turn out they were useful: as they were moving through France, they were challenged over the movement of this kit.”

While there are no official guidelines for this, border guards, police, and security officers are humans, and are just as confused by the shifting rules, and scared by the growing numbers of infected and dead. It is easier to create a document, than find out you need one mid-transit.

Limit entry where you can

It is also a good idea to be equally cautious about who enters your data center. Both attorneys praised Equinix’s decision to heavily restrict access to facilities in four countries.

“Inevitably, there will be Equinix customers who are deploying kit in the Equinix data centers where it can't readily be done by Equinix personnel,” Chester said. “But if you can radically reduce the number of people who are coming into those buildings, and therefore reduce the risk of somebody who is suffering from the virus, effectively then shutting down that site to personnel while it's deep cleaned, you therefore reduce the risk of outages.”

Should someone come into the facility who later is revealed to have Covid-19, it is also imperative that the data center operator lets customers know - something Digital Realty did when someone with coronavirus visited multiple sites.

“It is an area that there's been some discussion about,” Plowden said. “In the US, if I am the manager of a facility, and I have made a mistake, or I have allowed contamination because I didn't question someone or I didn't stop someone that was infected and they came in and infected that facility... I think we will see lawsuits related to that, not just in the data center area. Whether they're successful or not, I just don't know.”

Plowden said that the legal situation was unclear, but likened it to premises liability: If a landlord knew that people were getting mugged on a parking deck and didn’t inform tenants that were mugged there later, the landlord would face liability.

“If an owner of a facility knows about contamination, and doesn't take some precaution to alert its customers or tenants and then that customer or tenant gets sick, I think we see some legal liability that would arise.”

Beyond these legal risks, the current bump in demand, and delays in supply, it’s hard to understand what the longer-term impact of the coronavirus will be, especially as we don’t know how long this will last.

But it’s clear that there will be an impact. Contracts will change to cover pandemics, companies will draft more business continuity plans to cover a similar event, and there will be new insurance offerings.

“I expect that there will also be some long term changes in terms of stockpiling critical supplies for facilities,” Plowden said. “We’ll definitely be left with lessons learned, just as there were from the Great Recession.

“We get smarter over time, and we improve the documents, and people will naturally think, ‘Well, why did we not think of this before?’”