Chipmaker Nvidia’s data center sales surpassed its gaming revenue for the first time since it was founded almost three decades ago.

Its gaming business continued to rise at a steady pace, up 26 percent year-on-year and 24 percent compared to Q1, but the company’s data center chip sales went through the roof, with a 126 percent increase compared to last year and a 54 percent increase over the last quarter.

Overall, the company’s revenue grew by 50 percent year-on-year and 26 percent in the last quarter, and data center sales bringing $1.75 billion into the coffers; also beating predictions set at $1.71 billion.

It’s going well

According to IBES data issued by Refinitiv and seen by the New York Times, the company’s earnings and revenue outperformed analyst expectations; coming in at $2.18 per share versus the $1.97 a share they predicted; and quarterly revenue totaling $3.87 billion, against the $3.65 billion foreseen by analysts ahead of the company’s statement.

Part of the reason for the explosive growth is Nvidia’s acquisition of Mellanox for $6.9 billion earlier this year, making up 14 percent of Nvidia’s overall revenue in this quarter.

Another is the overall rise in data center chip sales on a global scale, in line with an increase in remote workers due to Covid-19 - despite Nvidia’s $100 million loss of income from disrupted supply chains in China in the first quarter.

"We believe that the future computer company is a data center-scale company," Huang said in an earnings call. "The computing unit is no longer a microprocessor or even a server or even a cluster. The computing unit is an entire data center now."

Even with comparatively slow growth in its gaming division, company CEO Jensen Huang said he expects the next quarter will be a good one for the business segment, as it is set to introduce its first gaming graphics card based on its Ampere architecture.

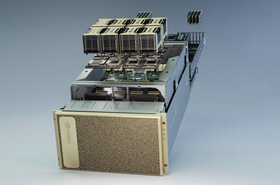

In May, the company began selling its A100 GPUs for data centers, also based on the Ampere architecture, marking its largest-ever performance leap between two releases.

Whether or not the company decides (and is allowed) to acquire chip designer Arm will undoubtedly have a significant impact on how its HPC and data center capabilities evolve in the future, but this has yet to be confirmed.

Finally, while sales of chips to the automotive sector plummeted as a result of the pandemic (down 47 percent year-on-year), Huang said that he expects overall revenue to rise by 46 percent in the next quarter, predicting revenue of $4.4 billion (plus or minus two percent).