The US government has allocated approximately $120 million from the CHIPS and Science Act to Polar Semiconductor to support the expansion and modernization of the company’s manufacturing facility in Bloomington, Minnesota.

In a statement, the Department of Commerce said the funding will allow Polar to double its production of sensor and power chips within two years and introduce new technology capabilities to the site.

The expansion is expected to cost a total of $525 million, with an additional $75 million in funding coming from the state of Minnesota and $175 million in private equity investment from Niobrara Capital and Prysm Capital.

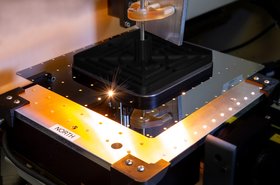

In addition to manufacturing chips for the automotive and consumer markets, Polar Semiconductor also produces power chips for use in servers and data centers, switch mode power supply, and megawatt power systems. This includes high-voltage integrated circuits and 40V MOSFET transistors which are found in microprocessors and memory devices.

The Department said the funding would lead to additional private capital being invested in the company, transforming Polar from a “majority foreign-owned in-house manufacturer to a majority US-owned commercial foundry.” Polar is currently jointly owned by New Hampshire-based Allegro MicroSystems and Japan-based Sanken Electric.

The expansion of Polar’s plant will also create over 160 manufacturing and construction jobs in Minnesota, the Department said. Polar and its construction partner Mortenson have both committed to a Project Labor Agreement, a pre-hire collective bargaining agreement that establishes the terms and conditions of employment for a specific construction project.

Polar is also a member of the Minnesota CHIPS Coalition Workforce Partnership, a group of 35 employers, education and training providers, and labor organizations that aim to improve workforce development programs to support immediate and future workforce needs.

Under the terms of the agreement with the Department of Commerce, Polar has committed to expanding access to high-quality and affordable child care for its facility workers. It has also transitioned its operations at the semiconductor fab to rely on clean and renewable energy resources and has put water conservation efforts in place.

“We are very pleased to announce this historic investment in Minnesota semiconductor manufacturing. Our expanded manufacturing facility will allow us to increase capacity and branch into innovative technologies to serve new customers and markets,” said Surya Iyer, president and COO of Polar Semiconductor.

“Polar and its employees are grateful to the US Department of Commerce and the State of Minnesota for their commitment to the future of American semiconductor manufacturing.”

CHIPS Act funding allocations continue to roll out

In April, Commerce Secretary Gina Raimondo said she expected all the grant money under the CHIPS Act to be allocated by the end of this year.

To date, the White House has allocated the following funding:

- In February 2024, GlobalFoundries was awarded $1.5 billion by the US government under the act to subsidize the company’s future semiconductor production capabilities and support expansion plans for its New York and Vermont sites.

- In March, it was announced that Intel would receive $8.5 billion in direct funding, $11bn in low-interest rate loans, and a 25 percent investment tax credit on up to $100 billion of Intel’s capital investments under the Act. It will be used to support the company’s investments in Arizona, New Mexico, Ohio, and Oregon where the company is expanding its chipmaking facilities.

- In early April, TSMC signed an agreement with the US government in April that would see the company receive $11.6bn under the CHIPS and Science Act to build a third fabrication plant in Phoenix, Arizona. This newly announced TSMC fab will produce 2nm or “more advanced process technologies depending on customer demand” and is expected to be in production by the end of the decade.

- Also in April, it was announced that Samsung Electronics would receive $6.4bn in direct funding to build a semiconductor cluster across a number of locations in Texas. This includes two semiconductor foundries producing 4nm and 2nm chips; an advanced packaging facility for high memory bandwidth; a research and development facility in the city of Taylor, and the expansion of an existing Samsung site in Austin to support the production of fully depleted silicon-on-insulator (FD-SOI) process technologies.

- That same month, Micron allocated up to $6.14 billion in direct funding under the CHIPS and Science Act, which will be used to support the construction of three new memory chip fabs: Two in Clay, New York, and one in Boise, Idaho, which the company started construction on in 2023. The two fabs in Clay are the first of a planned four-fab “megafab” focused on DRAM (dynamic random-access memory) chip production, while the Boise facility will be a high-volume manufacturing (HVM) fab, also focused on the production of DRAM chips.