When the ride-hailing company Lyft filed for its IPO in March, one figure attracted particular attention in the mission-critical infrastructure industry: Lyft will pay Amazon Web Services (AWS) around $300m a year to provide cloud services. This is a very big number, especially when spread over, say, five years ($1.5bn).

For that, Lyft gets a lot: Data center capacity, organized into availability zones; IT infrastructure (processing, storage, network); a mass of tools for management, development, recovery, orchestration; and so on.

But the sheer scale of the dollar figure has prompted many to ask if it is really economic for Lyft, or other large companies, to use to the public cloud on that scale. Surely it would be more economic to build a private cloud, either using colos or even, in the long run, at least some of its own data centers?

Public vs private cloud

The same questions might be asked of Snapchat, the social media company, which has a $2bn multi-year contract with Google and a $1bn enterprise license with AWS.

Uber, which dwarfs Lyft in revenues ($11.3bn vs. $2.2bn in 2018), adopts a hybrid data center strategy, using both cloud and colocation services. But useful comparisons are impossible, given the available information. Uber has argued it can do some things as cheaply as the cloud, but still uses AWS and Google Cloud Platform to support expansion and certain services — for example, it pays Google $75m a year for Google Maps. In 2018, Uber spent $221m on data center leasing, but, without giving a base number, said IT hardware spending rose by $75m year on year.

Given that so few organizations have compute requirements on the scale of or of the type that ride-hailing platforms do, it is difficult to draw a lot of lessons — although Uber’s withdrawal from China, which cost $80m, does show the risks of investing in infrastructure during periods of rapid expansion.

The economics of this was considered by Dr. Owen Rogers, a cloud economist with 451 Research (Uptime Institute’s sister company), in a recent 451 Research report (Dramatic headlines on Lyft's AWS spending miss the point, March 2019). Rogers makes the point that Lyft’s spending on AWS in 2018 was just five percent of its total revenue. This is not a big number, especially given that infrastructure is a critical part of the Lyft offering.

Is private cloud more efficient than public cloud?

Rogers suggests that Lyft probably could build its own private cloud infrastructure more cheaply, based either in colos or in some of its own data centers, although it is highly unlikely it could have built out this kind of infrastructure at scale so fast. But it would be extremely risky to do so, and the benefits might marginal.

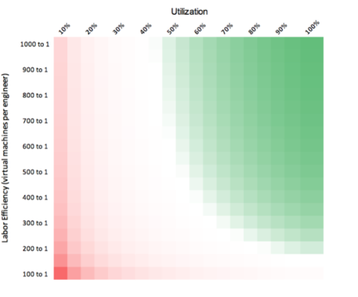

Drawing on some previous work, Rogers explains that the key factors that determine costs when assessing cloud versus colocation are utilization of the hardware/infrastructure and the labor efficiency, which means how many virtual machines each engineer can support. The 451 Research graphic above shows that if these numbers are good (green area), it is more efficient not to use private cloud. But the risk is great, and most organizations fall in the red zone, where public cloud is cheaper.

This insightful analysis, of course, cannot take into account all the factors at play and is based on average costs of colocation facilities. Each case is different. Dramatic improvements in operational efficiency or, more likely, rising costs of operations (such as power prices) or cloud services will swing this one way or another.

Prices, even at that this level, play a limited role in the decision of how to build out infrastructure. In most cases, the use of public cloud, colocation and company-owned data centers is determined a matrix of factors - finances, opportunity (time to deployment/lock in), risk, compliance, sustainability and security - a set of factors that Uptime describes as FORCSS. In many cases, a decisive advantage in one area (cost) is outweighed by big barrier in another, such as compliance.