Growth in demand by Technology, Media and Telecoms (TMT) companies has led to the sector accounting for more than half (54 per cent) of all data centre take-up across Europe over the last 12 months, according to new research from global property adviser CBRE.

Amsterdam in particular has benefitted from this increase experiencing a rise in data center take-up of 30 per cent during 2011. London has also seen a significant rise in activity by the technology sector, mirrored by demand for office space, with the TMT sector accounting for 1.8 million square feet (equating to 18 per cent of total London? office take-up) in 2011.

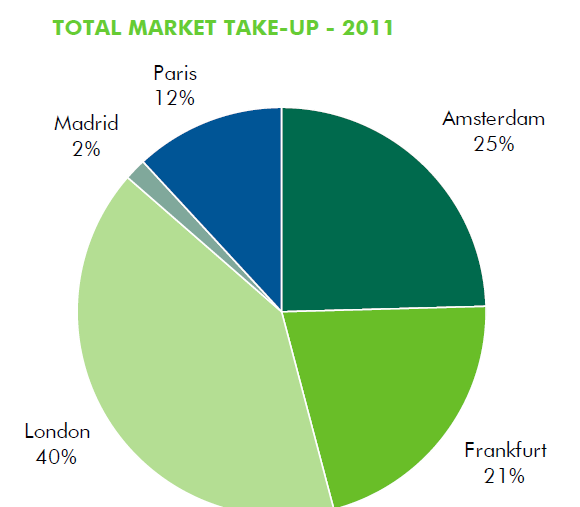

CBRE’s quarterly European Date Centre ViewPoint analyses the five tier one data centre markets across Europe – London, Paris, Amsterdam, Frankfurt and Madrid. The research found that exposure to the Eurozone has impacted demand in all major markets in 2011 to a varying degree. Despite wider concerns, Amsterdam and Frankfurt both saw demand grow last year with take up in London, Paris and Madrid bearing the brunt of weakened corporate activity. CBRE expects demand across Europe in 2012 will be similar to 2011, which saw a total of 47,105 square metres of data centre space transacted last year.

Growth

Andrew Jay, Executive Director, Data Centres, CBRE, said: “In 2012 we anticipate that unrelenting growth in Information Technology will continue to drive new demand for global data centre services with the TMT sector again expected to take the lead. Interest in Cloud computing has certainly captured greater attention this year and we would expect this to encourage increases in newbuild activity in 2012 with household technology names such as Facebook and Microsoft already committed to large scale developments.

Projects announced

IT integrators, carriers and hosting companies continued to maintain healthy levels of supply activity during the course of 2011. Most recently, Digital Realty Trust announced that it has signed a ten-year data centre lease with IT solutions provider Kelway at its Redhill facility, whilst in North London C4Lacquired space in Virtus’s Enfield data centre. Earlier in the year, the telecom sector saw companies such as Neos Telecom (France), Slovak Telecom (Slovakia) and Global Iletisim(Turkey) all open data centres, whilst more recently Portugal Telecomcompleted the construction of a 75,000 m² data centre situated in Covilha. Amongst the hosting companies, SoftLayer Technologiesannounced that it would open its first European data centre in Amsterdam, investing some €55 million to include new network PoPs in Amsterdam, London and Frankfurt, whilst in Russia, Linxdatacenter launched its 9,000 m² facility in St Petersburg.

“Across Europe, the economic situation will continue to limit corporate commitments this year although inactivity over the past three years has led to an abundance of unsatisfied requirements waiting to come to market. Amsterdam will continue to grow in importance as strategic hub for a variety of connectivity led business sectors and as a result, data centre take-up activity in 2012 is likely to improve on 2011. London’s diverse mix of corporate occupiers also stands it in good stead for the coming year.”

CBRE has the world’s largest data centre advisory team. Over the last two years the team has represented occupiers in the acquisition of 1.6 million sq ft of data centre space in Europe, accounting for 75 per cent of all represented transactions in the market.