Data centers are picking up on faster optical Gigabit Ethernet networks, according to new research. Revenue from 10, 40 and 100 Gigabit optical transceivers sold into the enterprise and data center markets grew 21 percent to $1.4bn in 2014, according to IHS Research.

This was almost entirely the result of increased 40G quad small-form-factor pluggable (QSFP) spending, says IHS Research. Data center transceivers account for 65 percent of the overall (telecom and data) 10G/40G/100G optical transceiver market. Specifically, total 40G transceiver revenue grew 81 percent in second-half 2014 over second-half 2013.

Data centers are deploying 40 Gigabit Ethernet

Andrew Schmitt, research director IHS Infonetics said: “40G transceivers are ramping up hard as data centers deploy 40 Gigabit Ethernet (40GbE), particularly as a high-density 10G interface via breakout cables. 40G QSFP demand growth over single-mode fiber is primarily a result of large shipments to internet content providers Microsoft and Google.”

Although 10G shipments in the data center continue to grow, they are being affected by the growth of 40G interfaces used as high-density 10G interfaces. Worldwide revenue for client 10G modules was flat year-over-year in 2014.

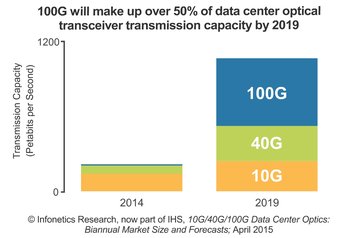

Schmitt said: “The market for 100G data-center optics is accelerating, but it has yet to be turbocharged by widespread data-center deployment in the way 40G QSFP optics have,”. “This will change dramatically in 2016 as cheap 100G silicon reaches production and QSFP28 shipments surge as a result,” he adds. “Next year is going to be huge for 100GbE.”

IHS Infonetics expects that the datacom optical transceiver market will grow to over $2.1bn by 2019.

The data center is now set to be the engine of any overall growth in optical transceiver sales over the next few years. Data centers now represent 65 percent of the overall telecom and data communications market for 10G/40G/100G optical transceivers. Transceiver sales should grow to more than $2.1 billion by 2019, IHS Infonetics predicts.