Over the past few years, Beijing has emerged as one of the top destinations for data center investment.

However, given the current situation whereby new data center projects in Beijing are no longer approved due to the industrial shift to the Tianjin-Hebei area, future demand for data center capacity in the Chinese capital will likely be fulfilled by neighboring cities in Hebei province.

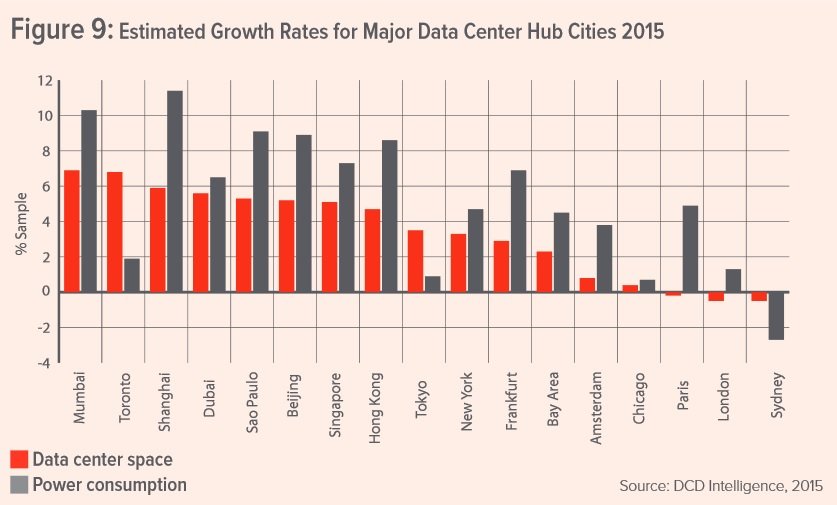

This has, to a large extent, limited the growth rate of Beijing’s data center markets since the end of last year. The market also suffered from slow adoption of cloud and outsourced infrastructure, when compared to places like Hong Kong or Singapore.

According to the latest Metropolitan Hub series report by DCD Intelligence (DCDi), Beijing currently has 540,000 square meters of white space, including both commercial and enterprise facilities.

This accounts for nearly 30 percent of total white space available in China.

Slow and steady

Over the past five years, China’s booming economy has fueled significant demand for data centers in Beijing – a city of almost 21.5 million residents. According to DCDi, investment in data centers in Beijing and its satellite cities has increased by 65.3 percent between 2012 and 2015, making it the top market nationwide.

And yet, we are not expecting many new facilities to be announced in Beijing: in order to distribute the city’s industrial base across a wider area, the government of China has drafted a development plan that aims to boost its economic integration with surrounding regions, namely Tianjin municipality and Hebei province.

The data center industry, which consumes large amounts of electricity, is covered by the industrial transfer plan so many of the future projects are likely to be located outside the capital - the only exception being new, energy efficient data centers with a PUE below 1.5.

The report also notes that the Beijing market currently prioritizes availability over efficiency, and that this trend is likely to reverse soon as a result of the city’s growing energy vulnerability. The current target for data centers is to lower PUE by 8 percent by the end of 2015.

Among the existing facilities, telcos account for 40 percent of data center space in Beijing, followed by third-party, carrier-neutral facilities.

DCDi predicts that the growth into 2015 will be in the IT and cloud services sectors and these will continue to reduce the space occupied by financial and government institutions.

However, the market could be sabotaged by long-standing concerns about the security of public cloud offerings, as operators in Beijing are reluctant to use external virtualized or cloud services to host critical services.

Around 59 percent of servers in Beijing are still located in ‘on-premise’ data centers. This means the Chinese capital is actually lagging behind smaller data center hubs in the Asia Pacific region which have embraced the cloud, with the regional average being 53 percent.

The information and analysis in the Metropolitan Hub Series: Beijing report are based on DCD’s annual data center census samples from 2011 to 2014 conducted among end-users, service providers and vendors in Beijing and other relevant markets.

You can purchase the entire 22-page report from DCD Intelligence.