The demand drivers for leased data center space are constantly evolving, particularly in recent years. With this continued change, more than 700 decision-makers, responsible for selecting their company’s IT and storage services, participated in a study commissioned by Vertiv to further understand this steady evolution.

The aim of the study, conducted by 451 Research, was to gain a better understanding of the changing nature of the demand for leased data center space. If we look back to the early 2000s, the majority of the demand for leased space was a direct result of telecom carriers or enterprises. However, we’re now seeing a greater demand from service providers, encompassing public cloud providers and enterprises that seek space inclusive of higher level services.

While analyst firms, investors and pundits alike have forecast a reduced demand for leased data center space as a result of this trend, these views do not take the potential future demand driven by wider IoT adoption into account. They also don’t account for the demand of hybrid data center space or the trend that not all workloads are now shifting to the cloud, for a number of reasons.

Opportunities ahead

As the report makes clear, the outlook for data center demand isn’t entirely negative. Here are the seven key findings that will drive current and future demand for leased data center space and how they will impact multi-tenant data center (MTDC) providers.

Continued cloud adoption

In less than a decade, cloud has gone from the margins to the mainstream, with widespread adoption seeing enterprises continue to shift IT from on-premise data centers to off-premise colocation, hosted private cloud and public cloud environments. Even though companies on average are retaining as much as 40 percent of their workloads in-house, and up to 36 percent of workloads in non-cloud environments, the majority of respondents are planning to increase their use of private and public cloud over the next two years.

IoT will further data center demand

Among our 700 respondents, there was nearly universal IoT adoption activity - only a minuscule 2 percent of the surveyed organizations said they were not working on any IoT projects. However, we are clearly at the early stages of the IoT maturity curve, with about two thirds (64 percent) identifying their current stage of IoT activity as ‘in testing or planning.’

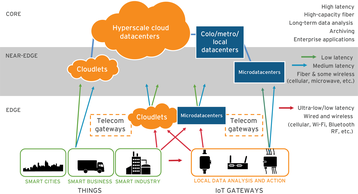

IoT projects will often require several locations for data analysis and storage. These include: endpoint devices with integrated compute/storage; intelligent gateway devices; nearby devices that perform local computation; on-premise data centers; colocation facilities; managed hosting sites; and/or network providers’ point-of-presence locations.

Not only are there a variety of hosting destinations for data analysis and storage, it’s also likely that many deployments will end up storing, integrating and moving data across a combination of public cloud and other commercial facilities – including colocation sites, and/or network providers’ point of presence locations.

Expanding IoT commitment

While it’s early days for most IoT projects, a significant amount of current IT capacity is being dedicated to IoT, according to respondents. Surprisingly, perhaps, 54 percent of respondents indicated that 26-75 percent of their current IT capacity supports IoT initiatives. Looking to the next two years, 73 percent of respondents said they expect up to three quarters (75 percent) of data center/cloud capacity will be used to support IoT initiatives.

Analytics workloads driving computing demands

Further to the cloud allowing data storage for IoT processes, it also allows the processing of IoT data, which is another great opportunity for data center providers. Public cloud is currently the most popular location (39 percent) for analysis of IoT-generated data, but by no means the only player. Indeed, data processing is distributed between colocation facilities (30 percent); local computing devices attached to data generators (30 percent); within network operator infrastructure (31 percent) and on-premise data centers (35 percent).

Workloads and providers

The nature of the IoT workload also affects the location for IoT data storage and processing. A little under half of the respondents (48 percent) mentioned that quality control/tracking systems were most likely to be processed close to the source of data. In order to meet this requirement, micro-modular data centers are likely to become more prominent, in addition to MTDCs that are located in relatively close proximity.

The undecided opportunity

For multi-tenant and micro-modular data center providers, organizations undecided on IoT infrastructure are like swing voters to political parties: they represent opportunities.

A quarter of the respondents said public cloud providers are the first choice for IoT storage and processing when it comes to infrastructure suppliers. There was a fairly even split between public cloud; and respondents choosing a mix of public, private and collocated data centers (21 percent). Additionally, 28 percent chose either network operators (14 percent) or colocation providers (14 percent).

Fog computing at the edge

Fog computing is defined by The OpenFog Consortium as “a system-level horizontal architecture that distributes resources and services of computing, storage, control and networking anywhere along the continuum from Cloud to Things.”

Among our respondents, there are certainly some very early adopters, with a surprisingly high 45 percent describing themselves ‘familiar’ or ‘very familiar’ with OpenFog. The key market driver for fog computing is real-time analytics on data streams, selected by over a quarter (26 percent) of respondents, closely followed by reduced network backhaul costs (24 percent) and increased application reliability (21 percent).

Key takeaways

Based on these premises, our report further identifies eight takeaways for MTDC providers:

- Managed services that simplify public cloud use or make it more secure, as well as private cloud options, are becoming more important to customers.

- MTDC providers with interconnection or managed services will fare well amid the growing demand for off-premises deployments.

- Colocation providers and telecom operators are in a unique position to address the public cloud’s specific challenges.

- The Internet of Things is an opportunity that should not be ignored by providers of data center capacity services.

- The emergence of IoT creates a new battleground regarding computing capacity location.

- IoT will bring applications and workloads that demand near real-time responsiveness (low latency), which dictates the potential placement of computing capacity closer to the network edge, or device, to minimize transmission latency impact.

- The fog/edge computing market will drive significant partnership opportunities.

- There will be a marketing focus on evangelizing data center services that support key fog/edge computing.

In addition to these takeaways, data center providers should give special attention to the verticals and countries with the highest proportion of organizations in the mature planning stages for IoT support. The research found that Italy, for example, has the largest percentage of off-premise organizations using cloud (67 percent) and China is the most aggressive in using colocation as an IoT data storage environment in the coming year. The most drastic transition related to IoT data storage is the move away from company-owned facilities. While 71 percent of all enterprises surveyed currently store IoT data on-premise, this figure is projected to drop to just 27 percent in a year’s time.

If one thing is clear, it is that the developments in cloud and the IoT will have a significant effect on data center demand. If data center providers are open to the opportunities that these emerging technologies offer, and the demand drivers for leased data center space, it will allow them to tap into new markets and stay ahead of the competition.