The world’s three largest colocation providers are rapidly increasing their revenues, but most of this this expansion is fueled by acquisitions, rather than organic growth.

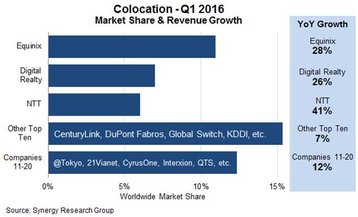

According to Synergy Research, Japanese telecommunications giant NTT managed to increase its data center revenues by 41 percent in a year, followed by Equinix and Digital Realty, which saw increases of 28 percent and 26 percent respectively. That’s well ahead of the total market, which grew by less than 10 percent between Q1 2015 and Q1 2016.

“Acquisitions by the big three and a few other players are helping to slowly concentrate colocation market power in the hands of operators that can afford to build and support huge data center footprints spanning multiple regions,” said John Dinsdale, a chief analyst and research director at Synergy.

Squeeze in the mid-market

It’s no secret that the colocation industry is in the midst of a major shift, with smaller providers snapped up by larger, global players. In recent months Equinix has purchased Telecity and Bit-isle, Digital Realty agreed to pay $1.9 billion for Telx and NTT acquired Germany’s e-shelter.

But to see the extent of consolidation, its impact needs to be quantified. According to Synergy, in aggregate the top three colocation providers grew revenues by over 30 percent year-on-year. The next ten largest companies on the list grew their colocation revenues by 7 percent, and the next ten – by 12 percent.

According to Synergy, businesses experiencing some of the highest growth include QTS, CyrusOne, CoreSite, China Telecom, DuPont Fabros and KDDI-Telehouse. Geographically, the APAC region saw the highest increase in colocation revenues.

The research outfit explains that changes in data center ownership are driven by the needs of service provider clients and large multinational organizations that require increased scale and broader geographic footprint that smaller companies are simply unable to provide.

“We’ve seen a constant stream of M&A activity over the past five years and several more big deals are in the pipeline – and yet there remains a very long tail of independent small-to-medium sized colocation operators. Many of these will continue to operate successfully by focusing on specific metros or countries, while others will inevitably succumb to market consolidation,” said Dinsdale.