Research suggests that colocation providers will have to diversify into cloud services if they hope to stay relevant - whether by building their own cloud, partnering with cloud providers hosted in their facilities or offering connections to public infrastructure from major vendors like AWS, SoftLayer or Azure.

According DCD Intelligence (DCDi), the cloud and its seeming ability to deliver more compute with fewer resources is disrupting traditional colocation business models, and organizations that don’t adapt and invest accordingly will be trampled by competition.

’The response of colocation providers to the rapid market uptake of cloud and the simultaneous threat and opportunity this presents, is a classic example of market evolution,” commented Nick Parfitt, analyst at DCDi.

“There is no single yellow brick road forward given the need to strike a balance between the need to provision established services and create new ones.”

Hybrid or bust

The report, titled ‘Colocation Provider Investment: Co-opting the Cloud for Future Growth’ states that colocation currently accounts for 23.6 percent of global data center space.

However, investments in facility equipment and IT optimization solutions by colocation providers as a proportion of the overall data center market are much higher, at 30.1 percent or around $40 billion.

Investment in colocation facilities is expected to rise at a steady pace to reach 36 percent of the overall data center market or $70.3 billion by 2020.

According to DCDi, the growth rate for colocation facilities through 2020 will be seven times higher than the growth rate for end-user facilities, but a third lower than growth of facilities built by cloud and IT service providers.

The most popular reasons for investment are the need to increase IT capacity while reducing operating costs. Cloud computing, virtualization and better utilization have also been quoted more frequently when comparing 2014 with 2015, along with sustainability concerns.

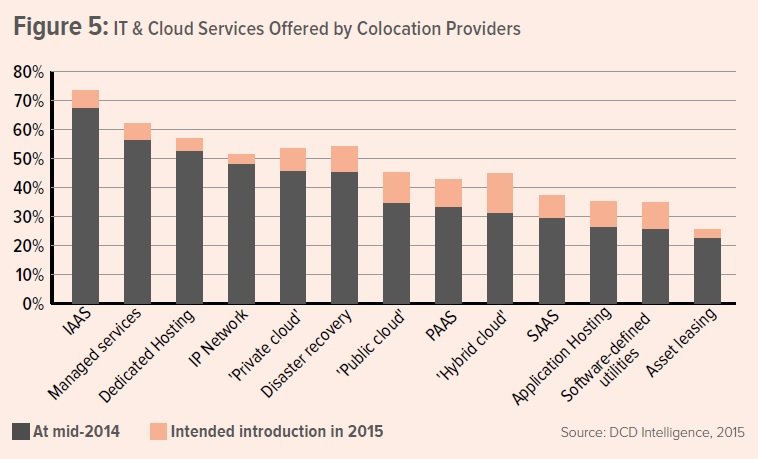

The report warns that most colocation providers will need to develop a hybrid approach to infrastructure to keep their customers happy. Over 10 percent of respondents to the survey said they were looking at the deployment of hybrid and managed public cloud in 2015.

This situation could result in symbiotic relationships, where colocation providers refer business to their public cloud partners in return for being able to promote the availability of cloud services within their facility.

However, major colocation players may need to take a longer-term view of their own service provisioning – cloud, after all, is based on data centers. As well as providing new sources of revenue and profit, the development of a cloud presence by colocation providers offers them considerable marketing benefits, especially the chance to expand and broaden their client base.

The research was based on 730 interviews with colocation, cloud and IT service providers in addition to 1,300 interviews with end-users, conducted a s part of the 2014 Data Center Census.

You can purchase the complete 30-page report here.